The electronic invoice, commonly known as an e-invoice, is gaining increasing importance internationally for its role in business transactions. There are numerous different reasons for this, such as changes in legal requirements in the B2G and B2B sectors, a simplification of tax requirements, increased transparency, and the growing optimisation and digitalisation of invoicing processes.

In this article, we’ll take a look at the development and functionality of an e-invoice, as well as the challenges and benefits of e-invoicing for companies.

Definition of an electronic invoice

So, what is e-invoicing? Let’s start with the definition of the electronic invoice according to the EU Directive (Directive 2014/55/EU of the European Parliament and Council from the 16th of April 2014 on electronic invoicing for public contracts), which states that invoice recipients in public tenders are obliged to accept electronic invoices.

Definition of an e-invoice: an “electronic invoice” is an invoice issued, transmitted, and received in a structured electronic format that enables it to be automatically and electronically processed;

This EU Directive is solely concerned with organisations which provide services for public procurement and issue invoices as part of these projects or undertakings. The invoice recipients, who in this case are public companies, are obliged to accept electronic invoices. According to the same EU Directive, there is no obligation for the invoicing party to issue electronic invoices, however individual states are free to tighten up these regulations when specific scenarios call for it. We’ve provided a comprehensive summary about this and the situation in Austria in our article, “EU Directive adopted for electronic invoicing in public procurement.”

While the structuring of data records through e-invoicing sits at the heart of the EU Directive and provides for further central elements that an e-invoice should contain, the situation from a tax point of view looks somewhat different. In regard to tax law requirements, there are country-specific variations which must be observed in order for companies to be legally compliant when using e-invoices for business transactions.

From a tax law perspective, the implementation of e-invoices is not a specifically technical implementation or indeed tied to a specific format; rather what is important is that a correct invoice is created from which input tax (for example, VAT) can be deducted.

The following are, among others, the required criteria:

- Authenticity of origin, relating to the certainty of the service provider’s identity and the identity of the invoice issuer.

- Integrity of the content

- Legibility – readable by humans

We will return to these points a little later in relation to the requirements for e-invoicing. As is already evident from the definition of an e-invoice, there are numerous different criteria that need to be complied with due to different legal requirements. Because of this, companies need to consider a range of legal principles, as well as country-specific regulations, in order to be fully compliant when using e-invoices.

An introduction to e-invoicing

The beginning: paper invoices

Even today, many invoices are still sent as paper invoices. This is a questionable format to use due to its consumption of valuable resources and the costs incurred by both sender and receiver. Not only are there additional postage costs involved, processing invoices manually also brings about other costs, such as personnel and infrastructure expenses, which make the overall process considerably more expensive.

One step further: PDF invoices

After the paper invoice, comes the PDF invoice. PDF invoices have become increasingly popular since the discontinuation of the formerly mandatory electronic signature. This change means that PDF invoices can now be sent via e-mail or made available for download. Although in comparison to paper invoices, PDF invoices reduce the effort for the sender, due to the change in media, they do not significantly reduce the effort for the receiver. This is because PDF invoices can only be transferred to the recipient’s respective ERP/FIBU system manually or by using copy-paste, as the PDF format itself is unsuited to recreating machine-processable data. Formats which are better suited to this are XML and EDIFACT.

The e-invoice

Let’s look more closely at e-invoices and the significant changes that adopting this format brings about for those who use it.

What is an e-invoice in essence and what makes it different from the paper and PDF invoices which came before it?

In contrast to paper or PDF invoices, the e-invoice doesn’t require any manual input from users and instead enables a fully automated approach; e-invoices allow organisations to transfer invoicing information electronically, receive it automatically, and to have that information processed within the recipient’s own system.

Unlike other types of invoices, the e-invoice presents its contents in a structured and machine-processable format which enables automated processing. During sending, the e-invoice generates a machine-processable format which is sent directly to the IT system of the receiver. This occurs without any manual intervention from the receiver and from this point the invoice is ready to be processed further.

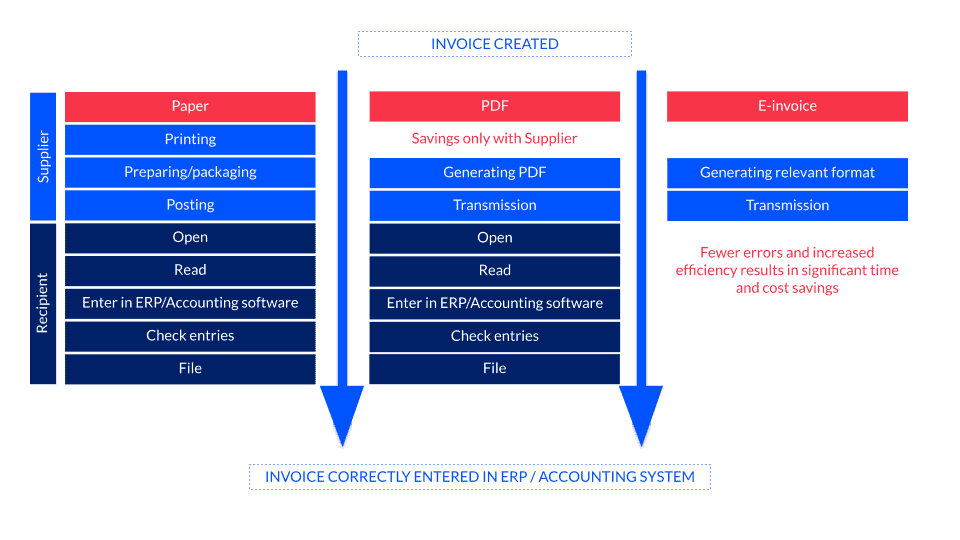

Comparison of invoicing methods

Using e-invoices / EDI invoices – challenges and requirements

Challenges in cross-border trading

Due to the country-specific formats and protocols which exist in relation to e-invoicing, there is a need for know-how and flexibility in cross-border trading, in particular relating to e-invoicing implementation. For many organisations, meeting the respective requirements needed to trade across borders can present something of a hurdle. It’s therefore important to evaluate if these challenges can be dealt with in-house, or whether it’s worth bringing in an external service provider with the necessary know-how to ensure a successful outcome.

In addition, the ViDA, issued by the European Commission, poses further cross-border trading challenges for companies.

VAT in the Digital Age (ViDA)

On December the 8th, 2022, the European Commission proposed a series of measures as part of ViDA (VAT in the Digital Age) to both modernise the value-added tax (VAT) system and make it more resilient against fraud. These measures were introduced in response to the loss of €93 billion in VAT in the EU in 2020. It is estimated that around a quarter of these losses can be attributed to VAT fraud in inter-community trade.

The European Commission has launched the “VAT in the Digital Age” initiative to improve the taxation of cross-border services and goods and adapt it to the challenges of the digital economy, in doing so closing loopholes and simplifying business procedures. The aim of the initiative is to ensure that businesses, in particular online retailers, make the correct VAT payments.

The following is an outline of the three main changes resulting from the ViDA:

- A new, real-time digital reporting system based on e-invoicing is to be introduced in 2028. In other words, e-invoicing is to become mandatory for all cross-border trading as of 2028.

- Updated regulations regarding VAT for the platform economy. Platforms for arranging passenger transport and short-term accommodation will be responsible for paying VAT to the tax authority, unless this is done by platform users themselves.

- Building on the existing “VAT One-Stop-Shop” model for online shopping businesses, VAT payments will be simplified for cross-border trade. Businesses will only need to register once for VAT purposes and will be able to fulfil all their VAT obligations through an online portal in a single language. This means that it will be sufficient for businesses to perform just one VAT registration when selling to consumers across the EU.

ViDA and electronic invoicing

ViDA aims to move towards real-time digital reporting based on electronic invoicing for companies that trade across EU borders. Key advantages arising from this include the reduction of administrative and compliance costs.

Compliance with the EU format is also addressed here. In cases where national e-registration systems are in use, they must support the EU format, which for electronic e-invoicing is EN16931. Business owners will need to bear in mind that the start of mandatory e-invoicing for cross-border trade has been set for 2028.

More information on ViDA (VAT in the Digital Age) can be found on the European Commission’s website under Taxation – Value added tax (VAT).

Ensuring the integrity of the invoice

As with previous invoicing formats, e-invoices are considered complete and unimpaired if the contents of the invoice have not been tampered with or altered in any way. However, this does not automatically mean that the invoice which has been issued contains the correct content.

Authenticity of the origin of an invoice

If the identity of the service provider or the invoice issuer can be guaranteed then the invoice fulfils the requirement for authenticity of origin. Authenticity can also be guaranteed through traceability.

Readability

The contents of each invoice should be fully legible and comprehensible. With e-invoicing, this can be facilitated through the use of the standardised messaging format.

Companies can choose to use one of a number of procedures to reliably meet the above criteria. However, as well as these requirements, there are, for example in Austria, the following additional e-invoice content requirements, which should also be taken into account:

- Name and address of the supplying company, or the company performing a specific service

- Name and address of the invoice recipient

- Quantity as well as description of the object of the invoice

- Date or time frame of services performed

- Invoice amount and tax rate

- Tax amount

- Date of issue

- Serial number

- VAT identification number (for invoices with an invoice amount of more than €10,000, the VAT identification number of the invoice recipient must be indicated)

In addition, depending on the type of enterprise, commercial law regulations also need to be observed:

- Legal status

- Registered office

- Company registration number

- Company accounts registrar

More information on this can be found in our blog article on the requirements of correct invoicing in Austria.

Furthermore, in Austria, additional content (such as the supplier number, order reference, etc.) must also be included, for example, when submitting an e-invoice to the federal government.

Archiving/Retention

It’s important to comply with retention periods for e-invoices. This applies above all to the tax office, which checks whether, for example, taxes have been paid correctly in Austria according to the Federal Tax Code. If the e-invoice has also been converted into another format, it must be clear from the retained file that no changes have been made to the document. For these reasons, it’s recommended to keep hold of both the original file and the converted file when possible.

Implementation of e-invoices

To ensure successful e-invoice processing and implementation, there are a number of additional aspects that need to be considered. Firstly, companies need to put in place workflows and systems for the creation and processing of e-invoices. Secondly, clarification regarding how e-invoices should be sent and received is needed. This clarification should pay close attention to country-specific regulations.

In addition to taking into account these requirements, there are also specific elements that the e-invoice itself must contain. The standard that specifies this was developed by the European Committee for Standardisation (CEN): EN 16931. Although this documentation provides useful recommendations for successful e-invoicing implementation, it only provides the fundamentals; each individual member state provides its own list of requirements, known as Core Invoice Usage Specifications (CIUS) to assist in the smooth implementation of e-invoices for businesses.

E-invoice standards and formatting

As we’ve seen, the CIUS only provides a basis for e-invoice implementation. Because of this, various versions of these have developed which has led to different e-invoice formats in different countries. This means that electronic invoicing can fall under different standards or specifications. In Austria, for example, the CIUS-AT-NAT was developed, while Germany has the XRechnung.

What exactly is regulated under EN 16931?

EN 16931 regulates core elements of electronic invoices, the requirements for which are syntax-neutral, i.e. prepared using plain or neutral language. However, the CEN does provide a list of permissible syntaxes (XML schemas) and we’ll provide concrete examples of those relating to the XRechnung in a later section of this article. What this regulation means for both sender and recipient is that for the e-invoice to be sent and received correctly both parties must be able to process the formats used.

How to send an e-invoice (using Germany as an example)

Different country requirements must also be taken into account when sending an e-invoice. In Germany, for example, there are two invoice receipt platforms (ZRE and OZG-RE) through which e-invoices can be transmitted to primary and secondary federal administration departments. For correct transmission, the sender must first determine which of these two platforms to use to send the e-invoice.

Various options can be used for the transmission of the e-invoice, with the type of transmission specified by each authority.

- E-mail & De-Mail (a German e-government communications service) with XML attachments

- Web entry

- Upload via an online form

- Fully automatic via Peppol

When invoices need to be sent frequently to federal government departments, it makes sense to use a fully automated transmission option via the Peppol protocol, which is supported by all authorities in Germany. In order to be able to transmit e-invoices via Peppol, a business will need a Peppol access point which can effectively communicate with the ERP system.

If the corresponding ERP system is already available in the company, it is worthwhile to convert an invoice in the respective ERP system into the necessary e-invoice format (e.g. XRechnung) automatically in order to transmit it immediately. To make this possible, there are fully automatic EDI solutions for the various ERP systems that can handle this conversion process. Through standardised import and export interfaces, the EDI systems can be integrated with the respective ERP system and therefore able to manage all electronic invoicing automatically.

When choosing the protocol, it is again important to consider which are prescribed by the country’s legislator.

How does e-invoicing work (using the example of XRechnung)?

Using XRechnung as an example, let’s now take a look at how e-invoicing works in practice.

As a mandatory e-invoicing standard in Germany, XRechnung affects all public institutions and authorities in Germany, as well as any companies that issue invoices to public administrators as clients. Suppliers, for example, must be able to create and send XRechnung invoices, while the authorities must be able to receive and process them.

Necessary steps:

- Clarify whether the company is legally required to create or receive the XRechnung (this varies from state to state).

- If so, implement the necessary e-invoicing standard in the company:

- Question current invoicing processes. How are outgoing and incoming invoices currently created and processed?

- If an ERP system is already in place, can it create or process electronic invoices?

Regarding the technical transfer of the XRechnung, according to the applicable standard, it must be transmittable or processed in one of the following two syntaxes:

a.) Universal Business Language (UBL)

b.) UN/CEFACT Cross Industry Invoice (CII)

Outgoing invoice – creating the XRechnung:

The relevant ERP system must create the invoice documents in the UBL or UN/CEFACT CII format. If this is not possible, the invoice must be converted to the required format. It is important that the conversion is automated and that the appropriate fields such as item description, identification numbers, units of measure, partner identification, etc. are maintained and can be converted accordingly. In addition, it is also essential that a receipt ID (called Routing ID in the XRechnung domain) is applied. Otherwise, the delivery of the document is at risk.

Incoming invoice – processing the XRechnung:

Before looking at importing an invoice via XRechnung, it is important to look at the workflow for approving and receiving invoices and to assess how well structured it is.The goal here is to convert XRechnung into a format that can be processed by the ERP system and to integrate the process seamlessly into that system. In addition to the format, the transmission channel (protocol) which receives the documents also plays an important role.

The various transmission options and the significance of the Peppol protocol are examined in detail in our white paper “Praxisleitfaden XRechnung und Peppol” (in German).

Verification of electronic invoices

As a general rule, companies should not send electronic invoices without prior verification. However, due to various legal regulations, there are differences in the criteria that need to be observed for successful invoice delivery. As mentioned above, most companies use an ERP system to map and automate processes. These systems can also export invoices in certain formats. However, these export formats are usually unable to meet the requirements for electronic invoices, making it necessary to convert or file them accordingly. Ideally, these conversions happen automatically, but this does not mean that the accuracy of the converted document is guaranteed. Various sources of error, for example, during input or directly during conversion, can lead to errors that need to be identified at an earlier stage. This is precisely where the verification of the e-invoice comes into play, so that these errors can be corrected earlier, long before the invoice is transmitted.

Verification can be performed in-house or by an external service provider. If a service provider is commissioned, it ensures that the e-invoice is transmitted to the relevant authority in accordance with the required standard.

Free online tool for validating Peppol and XML documents

Have you discovered our free online tool for validating Peppol and XML documents yet? It allows users to validate your documents according to EN 16931 (e.g. XRechnung), EHF, OIOUBL, A-NZ PEPPOL BIS3, CII Cross Industry Invoice, OpenPEPPOL formats, various UBL types, and many more.

Benefits of e-invoicing/EDI invoices

The use of electronic invoicing results in a number of advantages over traditional invoicing, although those benefits may vary slightly depending on several factors, such as the use of the transmission method. It should be noted that by cooperating with an external e-invoicing specialist, businesses can benefit from further advantages, depending on the specific services offered by the specialist in question.

Cost savings and efficiency gains in sending and receiving

Compared to sending and receiving paper invoices, electronic invoicing eliminates all costs associated with paper invoicing. The elimination of the manual paper process and automated invoicing process in the corresponding ERP/FIBU system also frees up the human resources involved in this workflow.

Reduction of material costs

The costs associated with paper, printers, postage, and more, are no longer a consideration.

Faster payment processes due to faster turnaround times

In contrast to paper invoicing, the time between sending and receiving an electronic invoice is significantly reduced. Once sent, the invoice reaches the recipient immediately. This significantly increases the probability of timely payments.

Minimising sources of error

By eliminating many manual processes thanks to automation, sources of error are significantly reduced.

Simplification of archiving

Archiving, which also plays an important role in invoicing due to the various retention periods required by law, is also simplified by e-invoicing. There is no need for a suitable room to store the paper invoices, nor is there any risk of invoices being lost in a fire. When invoices are archived digitally, they can be kept in electronic form and backups can be created.

Other advantages of using an external service provider in the context of e-invoicing include the following:

Technical compliance of e-invoices

External EDI service providers like ecosio ensure that e-invoices are fully compliant with e-invoicing requirements.

Cost savings through efficient and seamless automation

If an EDI service provider is contracted, then the automation of the invoicing process and the minimisation of manual processes is guaranteed, resulting in significant cost savings.

Flexible, scalable and future-proof

As experts in the field of electronic invoicing, EDI service providers make it possible to react quickly to changes in legal requirements, to scale invoicing processes if necessary, and make them future-proof.

User-friendliness

If the electronic invoicing process is integrated automatically into a company’s ERP system by the service provider, this enables companies to continue to work with familiar interfaces.

Zero hassle

Service providers such as ecosio further reduce complexity by enabling all invoicing processes to be handled via a single connection to the cloud. This means, regardless of the particular invoicing format or protocol, the stress and worry is taken out of the transmission and receipt of invoices.

The challenges of e-invoicing

E-invoicing, with its country-specific legal requirements and characteristics, not only poses challenges for companies when invoicing internationally, it also presents numerous hurdles when it comes to its technical implementation. Addressing this second challenge in particular will be of paramount importance for companies as having the correct technical integration is a necessary prerequisite for taking advantage of the many benefits e-invoices can bring about.

What this often means is that the switch to EDI invoices may initially involve increased costs to ensure its correct integration into a company’s system. However, over the long term these costs will turn into savings thanks to automation.

Getting the technical implementation right is an important first step in the successful implementation of electronic invoicing and companies need to be prepared to continuously adapt to both technical and legal requirements. This can be particularly challenging for internal IT departments. Depending on the availability of resources and internal expertise, company leaders must decide whether the e-invoicing requirements can be handled internally or whether an external service provider is actually the better choice.

If a company does choose to enlist the help of an external service provider, it’s important for them to consider how the necessary conversion will take place and which services are/aren’t included in the package they choose. For this reason, when choosing a suitable EDI service provider, it is crucial to take a close look at the services offered in order to successfully bring about the above-mentioned benefits of e-invoicing.

Country requirements

As we’ve already seen, there are numerous country-specific e-invoicing regulations which are especially relevant to organisations which operate on an international scale. In the list below, you’ll find some helpful articles that deal with how to implement and manage e-invoicing in different countries as well as related insights and an overview of that country’s specific e-invoicing requirements.

- E-invoicing in Belgium

- E-invoicing in Finland

- E-invoicing in France

- E-invoicing in Great Britain

- E-invoicing in Hungary

- E-invoicing in Italy

- E-invoicing in Norway

- E-invoicing in the Netherlands

- E-invoicing in Poland

- E-invoicing in Spain

- E-invoicing in Switzerland

- E-invoicing in Turkey

Summary

In summary, electronic invoices, also known as EDI invoices, e-invoices, and e-bills, are playing an increasingly important role in business transactions and accounting. Since the development and introduction of the EU Directive 2014/55/EU of the European Parliament and Council, e-invoices have gained even greater importance. While these legislative changes present challenges for many companies, they also bring about a number of sustainable benefits when implemented and managed correctly.

For companies, taking an honest look at existing capabilities and resources will be crucial to the correct implementation of e-invoices. If the question of whether e-invoicing can be handled internally without any worries cannot be answered with an unequivocal “yes”, it is worth consulting an external EDI service provider and expert in the field of electronic invoicing. This individual or team will not only take care of the complete automation of the invoicing process in conjunction with existing ERP systems, they will also know what to look out for in terms of different requirements and how to implement e-invoicing at the company in a manner that ensures long term sustainability.

If you are currently facing a similar decision, now is the time to get in touch. As a full-service provider in the field of electronic data exchange, at ecosio we are experts in electronic invoicing and its implementation. We are happy to advise you using our extensive knowledge and experience in the field.