An introduction to e-invoicing in Turkey

The Turkish tax system, which is known as GIB, is responsible for defining the national framework for e-invoicing in Turkey. This does not only include how invoices are sent and received, but it also relates to their storage as well. For some companies, adopting this electronic billing system is not compulsory – they can do so, but they are not required to. For others, though, e-invoicing is mandatory. This is the case for products that are subject to special taxes, for instance, light beverages, tobacco and alcohol, as well as those operating in the hydrocarbon sector. Another requirement under the current legislation is that legal books are delivered in an electronic format if a company sends out e-invoices.

Some of the important e-invoicing rules that need to be followed

Turkey e-Invoicing requirements

Here are some important pieces of information and some of the most notable rules that need to be adhered to when it comes to electronic invoicing in Turkey…

Mandatory status

As touched upon in the introduction, the use of e-invoicing is mandatory in certain industries. If you sell products with special taxes or you work in the hydrocarbon industry, you are going to need to set up your business for electronic invoicing. If you are unsure regarding whether you are required to send invoices in this manner or not, expert consultancy can assist. You have nothing to lose by setting up this system, either, as any company is allowed to do so.

Administrative transactions are required

You will be required to register as an e-invoicing issuer with the competent administration. In order to sign electronic bills, you must acquire an official digital certificate.

The use of an electronic signature

An electronic signature is required. This is to ensure the document is authentic, based on The Scientific and Technological Research Council of Turkey’s designated Financial Seals. Signing may be carried out with the issuer signature or, if using a service provider, by a delegated signature.

The format that is used

An XML format, UBL-TR (Universal Business Language) document, with Turkish extensions, has been designed for invoice formatting. It is intended as a single, common format for all stakeholders.

There are fiscal controls in place

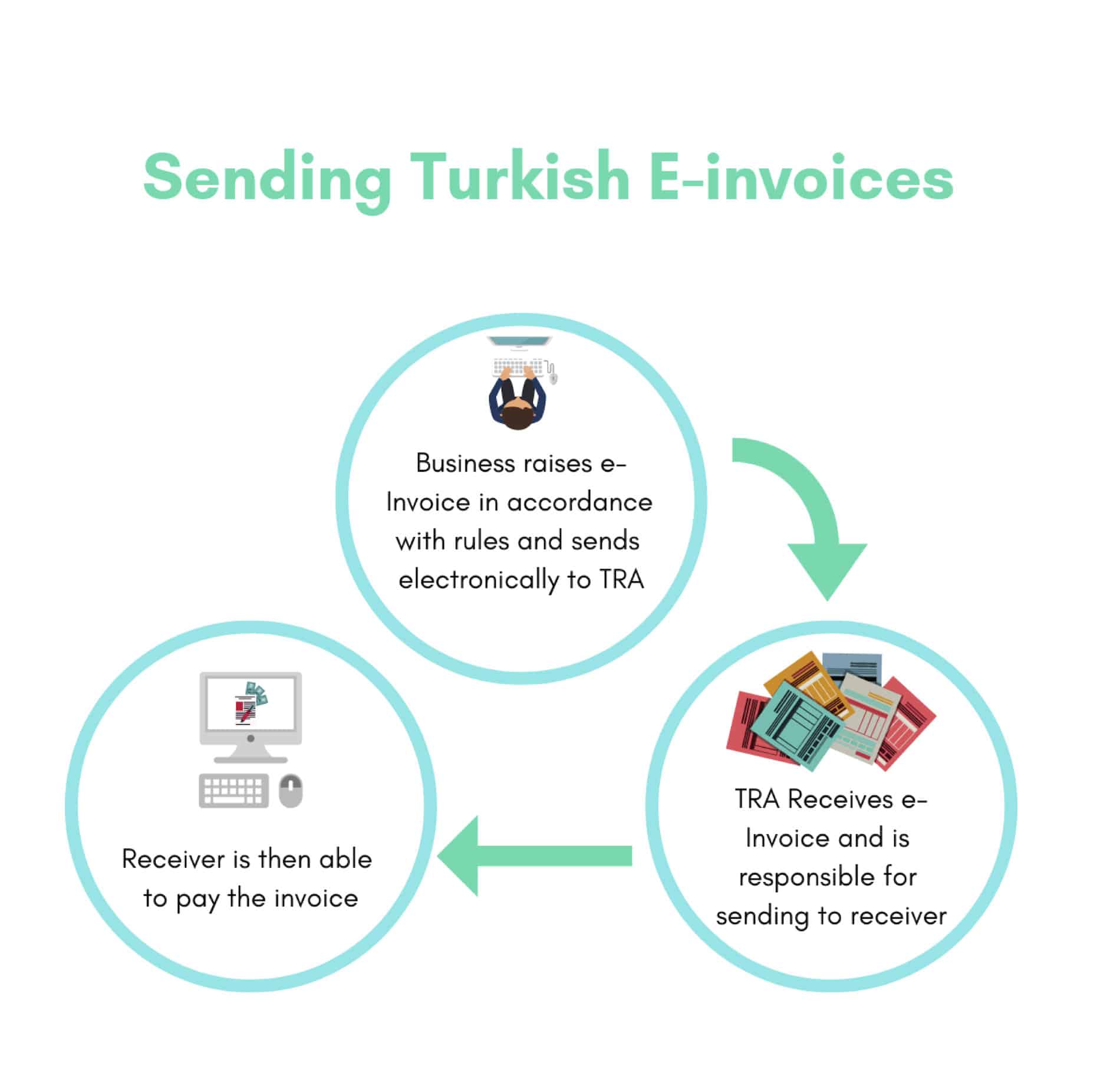

One of the most notable rules is that sending does not take place integrally, from the issuer to the person receiving it. This is in direct contrast to the EU model. With the Turkish model, the Turkish Revenue Administration (TRA) is the system hub. It operates a platform whereby invoices can be sent from the issuers, after which the TRA is responsible to making sure the receiver gets the invoice through their web services. Therefore, the TRA is effectively a middleman in terms of the electronic invoicing process.

You must receive e-bills as well

If you issue electronic invoices, you automatically become a receiver. This means that you have to accept e-invoices sent from other users who are registered under this system.

You must register with the Turkish tax authority

You need to register with a Turkish tax authority, such as the TRA, if you are going to send invoices electronically.

Storage requirements

There are also storage requirements in place. It is mandatory for both the sender and the receiver of any invoice to store it for at least ten years.

The complexities associated with introducing e-invoicing

One of the reasons why businesses did not set up e-invoicing correctly is because this represented a substantial undertaking for them. This is especially the case for businesses that are unable to deal with the Turkish language in-house, making the process much more costly. If you do not have any Turkish natives within your business, it can be extremely difficult to deduce the regulations and ensure you are in full adherence with them. A lot of companies have simply tried to undertake e-invoicing by reading snippets online or using tools like Google Translate, which can mean important points are missed and businesses are not compliant. Of course, it is expensive to hire professional Turkish translators, which is a real sticking point for many businesses.

There are also complexities from a compliance point of view, as you need to ensure you are adhering to all of the related rules and regulations that are in place. As you can see from all of the points that have been mentioned above, there are many different factors that need to be considered in this regard, and so it is of no surprise that a lot of companies have struggled with this. If you have not set up e-invoicing yet, or you have done so, but fear you’ve not implemented the system correctly, ecosio can provide you with expert consultancy services to get you back on track. With experience providing e-invoicing solutions for FatturaPA in Italy, as well as Peppol and more, we’re strategically placed to offer assistance with compliance across the globe. Why not get in touch to find out how a strategic partnership can further benefit your business?

Questions?

If you have any questions relating to e-invoicing in Turkey, please contact us or check out our chat — we look forward to assisting you!

Also, you may want to read our other blog article “The Journey to E-transformation in Turkey” on e-transformation in Turkey.

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.