The most recent report published regarding e-transformation in Turkey

On April 6th of last year, there was a new draft report published by the Turkish Revenue of Administration concerning e-transformation in Turkey. This note stated that e-delivery Note and e-archive are now mandatory for registered e-invoice taxpayers. The rule came into play at the start of 2019 and this draft report stated that if a taxpayer has a gross sales revenue that is greater than five million TL for 2017 and the following fiscal period, they are obligated to register for e-archive invoicing. Furthermore, this has become obligatory for taxpayers posting ads on the Internet, Internet advertisement service intermediaries, and e-trade intermediary service providers. In addition to all this, all registered e-invoice users are now obligated to use the e-delivery Note.

Why is e-transform important?

In order to keep up with the changing digital world, Turkey aims to bring into existence more ways to help businesses trading within the country and outside of it to ensure they process financial transactions properly. We’ve already provided detail on how businesses can overcome the complexities of e-invoicing in Turkey, and these new practices may help businesses to reduce costs further. Government regulations are in place to support these newly developed solutions, and it is thought that with further contribution to the e-transformation platform by stakeholders, the platform will gain even more traction and become ever more user-friendly.

To understand this transformation better, we take you through the platform, section by section, explaining how they work and what benefits they have to businesses selling to, and within the country’s industries.

E-archive invoice

The e-archive Invoice has been designed for e-commerce businesses that have a turnover greater than TL five million for the year of 2014. This came into force from June 1st 2016. It aims to save costs and time for those businesses operating in and with the country. With e-archiving, users are able to submit invoices to end-users and taxpayers irrespective of whether they utilise e-invoicing or not. Because of this, e-archive invoicing has become the preferred choice for many.

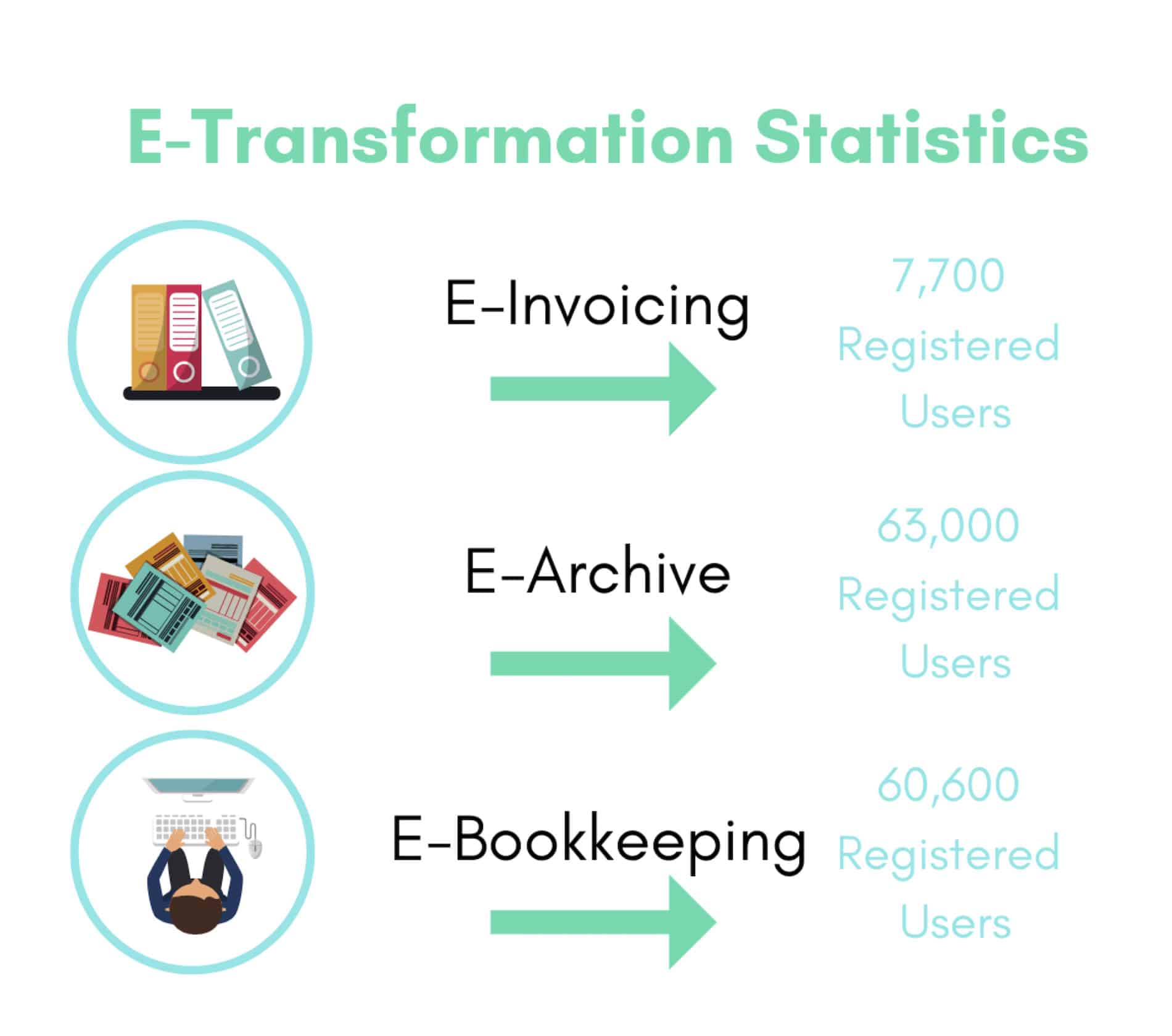

There are currently 7,700 registered users of e-archive invoice, and this number is predicted to rise by a significant degree in the near future because more and more businesses are expected to register voluntarily, so they do not need to process paper documents and spend time and money in archiving them.

E-invoice

As mentioned, we have put together a thorough guide on e-invoicing, and so we certainly recommend that you take a look at this for more information. The e-invoice solution ensures a secure passage of invoices that meet the strict standard set by the Ministry of Finance’s Revenue Administration between seller and buyer. As outlined in the blog mentioned earlier, e-invoices must be submitted through the TRA, whose responsibility it is to ensure they are sent on to the recipient. All users must be registered with the TRA, and responses are sent back to the sender through the TRA as well.

E-ledger

Compulsory statutory books that businesses prepare must be in an XML-based electronic format, which is an international available XBRL (extensible Business Reporting Language). To ensure source accuracy for these documents, companies are required to provide a digital seal and individuals must guarantee them with an e-Signature. These must be sent in the approved format to the Tax Authority’s portal, whereupon the Tax Authority approves them with its own seal.

E-bookkeeping

We also have e-bookkeeping, and at the moment there are 60,600 registered users of this. This is mandatory for any company that has a gross sales revenue that exceeds 10 million. It enables the creation of general ledgers, which was discussed above, as well as journals in electronic format.

Record keeping requirements

There are also now electronic recordkeeping requirements. This is mandatory for businesses that are involved in importing petrol products, including solvents. There has also been the publication of this being required for motor vehicles and alcoholic beverages too. And finally, another part of the electronic transformation that needs to be discussed is the new generation cash registry devices. These devices require cash register devices and POS systems to be integrated. Since April 1st 2016, retail businesses have been expected to utilise these new generation cash registry devices.

Other elements of the electronic transform in Turkey

Statistics on e-transformation in Turkey

Aside from the products that have been mentioned, there are some other important elements of this electronic transformation. This includes the e-payment and e-waybill. At present, there are no rules and regulations on this issue; however, there has been the creation of technical guidelines to assist with this. Furthermore, verbal discussions have taken place with the Authorities, indicating that there is likely to be a publication in the near future. We will, of course update you as the situation develops.

Changes for the better

Hopefully, you now have a better understanding regarding the regulated products that are in place for Turkey’s e-transformation. As you can see, there are a lot of changes going on in this country, which are designed to make it easier for individuals and businesses to manage their finances, while reducing costs and enhancing competitiveness. This brings about its own complexities for businesses trading within and with Turkey from overseas. At ecosio, we are able to offer a strategic partnership that will not only help companies to take advantage of all the benefits the e-transformation in Turkey brings, but will also help transform their ability to keep up with changing requirements in other countries too.

Do you have any questions?

Do you still have questions about e-invoices? Feel free to contact us, we would love to help you!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.