The past few years have seen several regulations concerning e-invoicing in Spain. These rules have also helped the Spanish government, and many affected companies, to experience some of the benefits of invoicing automation (whilst also helping Spain to meet the requirements of EU Directive 2014/55/EU).

In this article we look at the current state of play and what is needed for companies to comply with Spanish e-invoicing regulations.

What are e-invoicing regulations in Spain?

Suppliers of public bodies in Spain must send invoices to the general electronic invoice entry point PGEFe (Punto General de Entrada de Facturas Electrónicas), which is used by all public organisations. In accordance with 2015 legislation, all invoices sent to Spanish public bodies must be submitted in structured electronic format and be signed with an electronic signature.

Since 2018 all invoices exceeding EUR 5,000 in transactions involving public contractors and their subcontractors must be submitted through the FACeB2B platform. Businesses may use this platform for other transactions (e.g. non B2G transactions or those under EUR 5,000), though this is not yet mandatory.

Standards and communication methods for e-invoicing in Spain

The e-invoicing format used in Spain is FacturaE – an XML-based invoice format. FacturaE uses XML signatures and follows the XAdES standard.

The central platform used to send e-invoices to Spanish public bodies is FACe, or “Punto General de Entrada de Facturas Electrónicas”, which translates to “General Entrance for Electronic Invoices”. For suppliers and public entities alike this platform serves as the central invoice exchange platform.

In order to comply with the EU directive 2014/55/EU Spain has also developed a national Core Invoice Usage Specification (CIUS), setting regulations for public sector e-invoicing according to Spanish requirements.

In 2018 the platform was extended for B2B invoicing under the name FACeB2B. Companies that are working for the administration on behalf of other firms and that issue invoices over EUR 5,000 are already obligated to use the platform. Other Spanish companies can use FACeB2B voluntarily.

E-invoicing in Spain at a glance

| Standards | Mandatory? | Platforms | Length of archiving required |

| FacturaE(XML)

EN 16931 |

Yes – for B2G invoices over EUR 5,000 | FACe (B2G)

FACe B2B |

5 years |

What’s next for e-invoicing in Spain?

On 29 September 2022, Spain approved law 18/2022 (also known as “Crea y Crece”), which laid out plans for the gradual introduction of mandatory B2B e-invoicing over the following few years.

On 15 June 2023, Spain updated their draft e-invoicing decree concerning “Crea y Crece” to include proposed technical requirements. According to the decree, service providers will be obligated to support e-invoice transmission in CII, UBL, EDIFACT and Facturae formats. Other mandated actions will include delivering a copy of each e-invoice to the Spanish public platform in Facturae format, and including a digital signature when a service provider is used.

In addition, invoice responses will also be mandated, with invoice recipients required to alert the issuer to the acceptance or rejection of the invoice (and relevant date), as well as the complete payment of the invoice (and date).

At present, the timeline regarding mandatory e-invoicing compliance in Spain looks as follows…

Timeline

12 months after royal decree published:

- B2B e-invoicing becomes mandatory for large businesses (annual turnover > €8 mil)

24 months after royal decree published:

- B2B e-invoicing becomes mandatory for other taxpayers

36 months after royal decree published:

- Sending of invoice responses becomes mandatory for large businesses (annual turnover > €6 mil)

48 months after royal decree published:

- Sending of invoice responses becomes mandatory for self-employed professionals (annual turnover > €6 mil)

The wider picture

Since the introduction of the EU Directive 2014/55/EU European countries have been steadily introducing and amending e-invoicing rules and regulations to meet the requirements of the EU Directive. Predictably, given the potential for cost savings resulting from automation and optimisation of VAT reporting, many countries are moving towards mandating e-invoicing across B2B as well as B2G transactions.

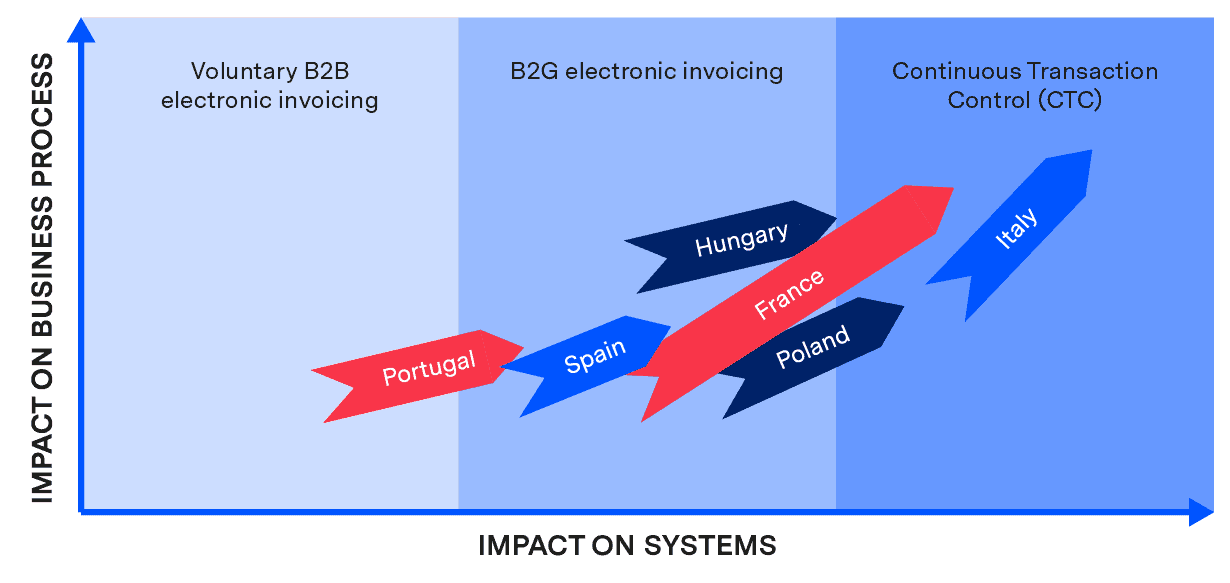

In the chart below, which shows how recent and planned legislative changes affect businesses’ requirements in certain key countries, we can see a clear trend. Governments across Europe are moving slowly towards a full clearance model. Indeed, some, such as Italy, are already there. While the government has not yet announced any plans to move to such a model in the near future, it seems likely that additional regulations will be introduced in the years to come increasing the scope of mandatory e-invoicing in Spain.

E-invoicing – The trend towards CTC

How can I meet e-invoicing regulations in Spain?

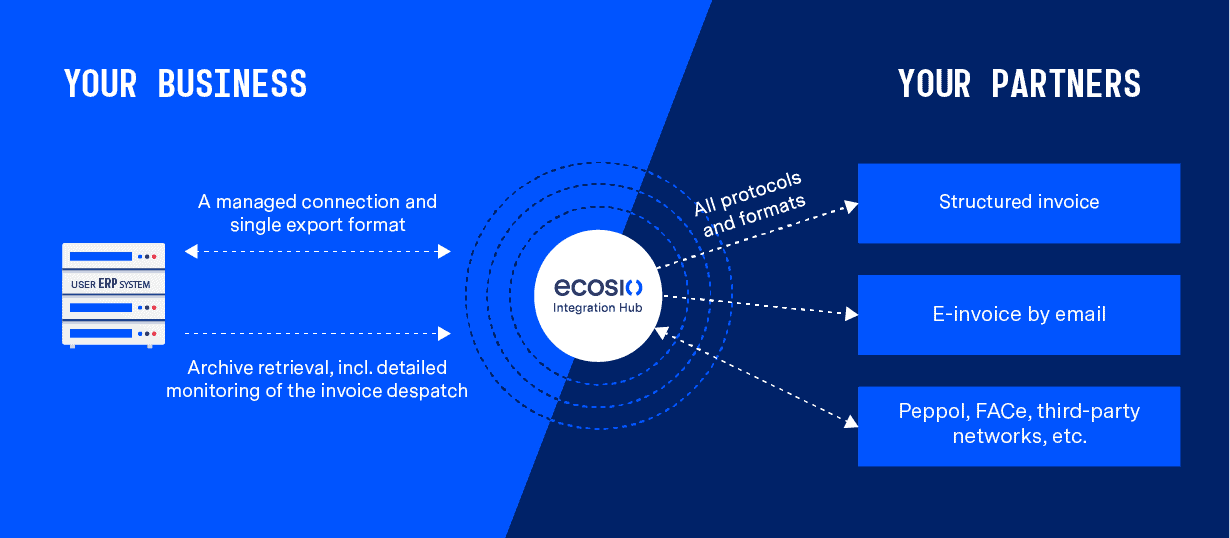

As with all exchanges of information via electronic data interchange (EDI), it is possible for internal teams to handle the transmission of e-invoices according to Spanish legislation. However, handling this internally can be difficult. As FACe is a proprietary Web Service, your internal team will need to set up the connection and signature routines. Further in-house teams will be responsible for ensuring everything runs smoothly and for providing necessary support. All of these tasks are tedious and time-consuming, particularly if your business exchanges a large number of invoices, has a large number of partners or conducts business in other European countries with different e-invoicing requirements.

Exporting e-invoices with ecosio

Even if you are able to cope with current requirements, it is worth considering for how long this will be the case as new regulations are introduced and your business expands into new markets.

Given the complexity of achieving e-invoicing compliance in Spain is not insignificant (and only likely to increase in complexity over time), for many businesses the most practical, cost-effective and future-proof solution is to enlist the help of an experienced service provider such as ecosio that can handle this process fully and ensure your data exchange processes remain reliable no matter what happens.

Want more information?

At ecosio we are experts in e-invoicing and electronic data interchange. Over the years we have helped thousands of businesses to streamline their supply chain and improve key processes, all while minimising pressure on internal teams.

For more information on how we can help you meet e-invoicing regulations in Spain and for advice on what practical steps you can take towards automation please contact us. We are always happy to answer questions.

You may also be interested in other articles regarding e-invoicing in…

More information on ecosio’s e-invoicing solution can also be found here.

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types for Spain, from CII (Cross-Industry Invoice) to UBL and FacturaE, we’ve created a free online validator.

Note: the validator supports all other European e-invoice formats as well!