In an effort to achieve significant savings, EU authorities in 2014 decided to implement new legal regulations relating to public procurement. Specifically, in order to harness the cost benefits of an automated exchange of invoice data in a structured format, on 16 April 2014 the European Parliament and the Council of the European Union agreed to adopt e-invoicing Directive 2014/55/EU, requiring all European government bodies to receive structured electronic invoices from suppliers.

The directive was proposed in order to increase the efficiency of public procurement across the continent and therefore bring significant savings to government bodies. According to estimates by the European Commission, every year over 250,000 EU public authorities spend around 14% of GDP on the purchase of supplies, works and services – equating to an annual spend of around €2 trillion. It was believed that only a 1% efficiency increase could potentially save EU states €20 billion per year.

Like other EU countries, Belgium has, for the past few years, been working in accordance with Directive 2014/55/EU to ensure all business-to-government (B2G) procurement now utilises e-invoices rather than unstructured or paper invoices.

The growth of e-invoicing in Belgium

Despite the fact that the e-invoicing directive was initiated in part to standardise B2B document exchange and reduce complexity for suppliers and customers, thanks to the federated legal landscapes of different countries, independent regions often have separate regulations/timelines. This is the case in Belgium as in several other European countries.

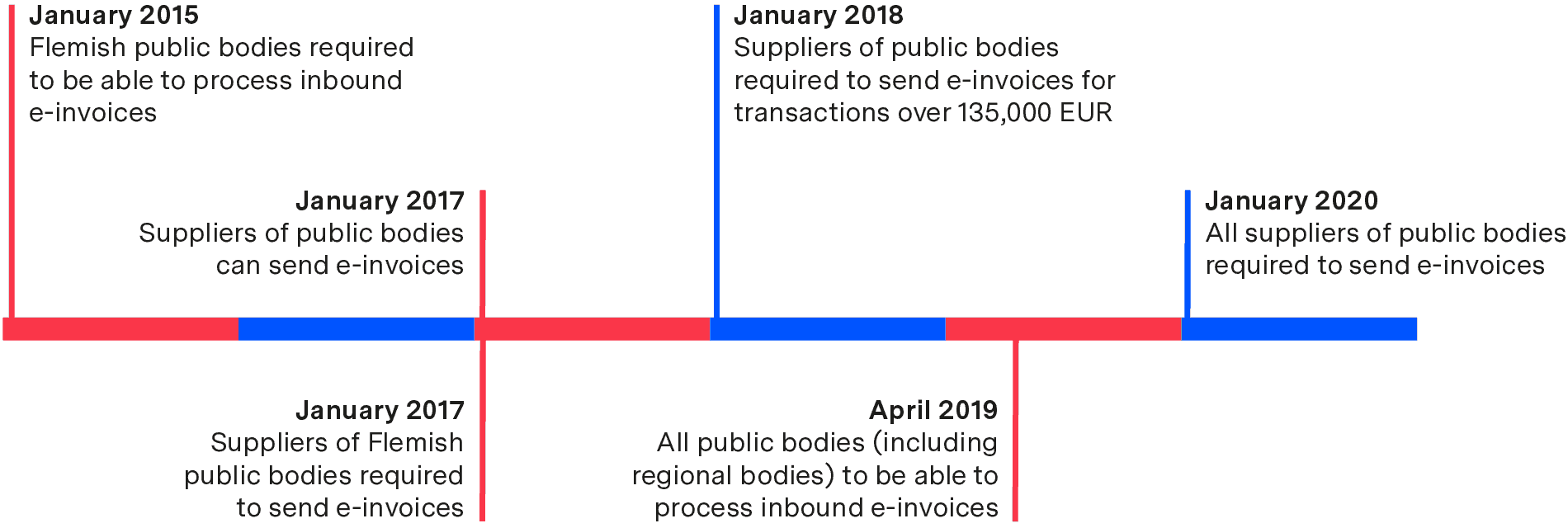

In the North, the Flemish government has been particularly swift in mandating e-invoicing compliance. In this region all public bodies have been required to receive electronic invoices since January 2015. Meanwhile suppliers of central public bodies in this region have had to send electronic invoices since January 2017, with paper invoices over 135,000 Euros being rejected from 2018. By contrast, Brussels and Wallonia have taken longer to implement such requirements.

Nationally speaking, suppliers have had the option to send electronic invoices to any government body since January 2017, while all Belgian public bodies have been required to be able to receive and process e-invoices since April 2019.

A brief timeline of key milestones relating to e-invoicing in Belgium can be found below.

How to send e-invoices

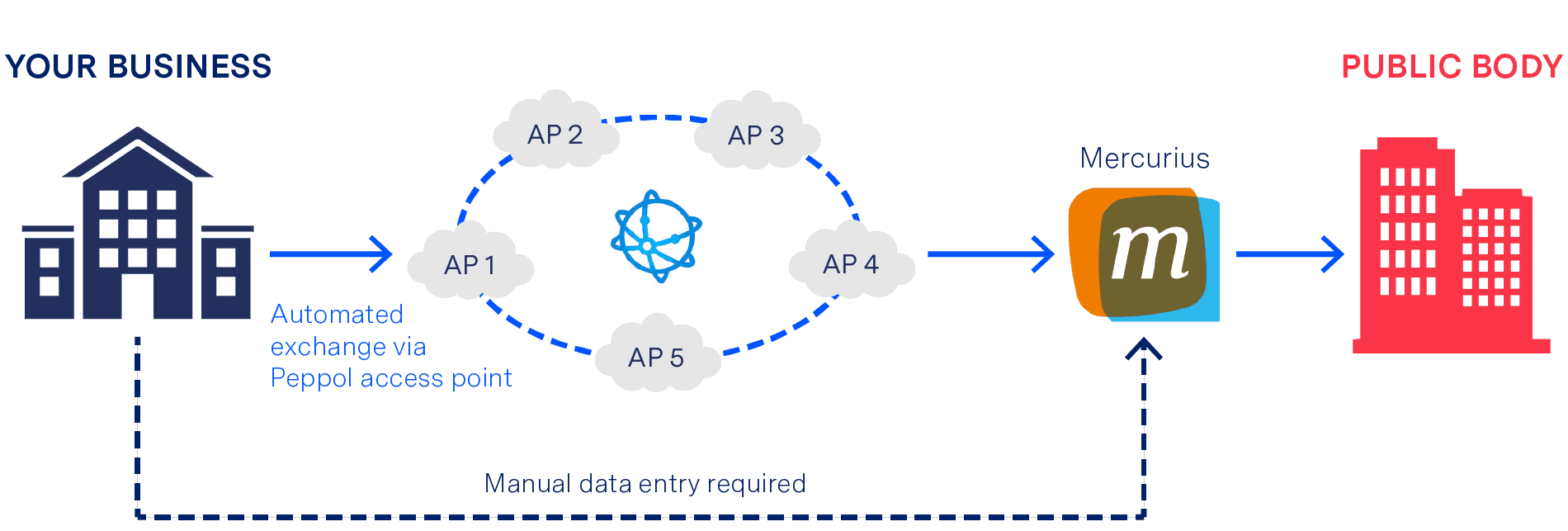

All B2G e-invoicing in Belgium takes place via the Mercurius platform. This platform was developed by the Belgian government and is connected to the Peppol network. Invoices and credit notes exchanged via Mercurius must conform to the Peppol BIS 3.0 document format.

Companies wishing to send invoices to public entities in Belgium can do so by two different methods:

1) Manual input via Mercurius

The most basic method is to use the manual invoice submission form on the Mercurius platform. In addition to allowing businesses to send structured invoices and credit notes, Mercurius’s interface also allows senders, receivers and intermediates to check the status of sent documents.

While this option is popular for those suppliers who do not currently have EDI capability and/or do not have multiple orders from Belgian public bodies, it is impractical for other businesses due to the extent of manual effort involved. Further, this method is only available for Belgian companies.

2) Via Peppol

The second method is to send documents via the Peppol network.

Unlike transmission directly via the Mercurius platform, exchange of documents via Peppol is fully automated. As a result, businesses sending invoices via Peppol can experience the cost and time benefits of fully automated message exchange.

In order to send documents via Peppol all you need is a connection to a Peppol access point, such as ecosio.

Peppol utilises the four corner model – those ‘corners’ being the sender, the sender’s access point provider, the receiver’s access point provider and the receiver themselves as illustrated below. By using this method there is no need for multiple connections or service providers no matter how many Peppol-connected companies you wish to trade documents with. Rather than setting up point-to-point connections or sender and receiver both having to have the same EDI service provider, the four corner model allows any Peppol-enabled to trade documents with any other connected company with minimal hassle.

What about receiving structured electronic documents?

As with sending structured electronic files, receiving such documents in Belgian exchanges can be handled one of two ways:

1) Via Peppol

Those companies who have a connection to a Peppol access point do not need to worry about receiving structured documents. Their chosen service provider should ensure that the necessary mapping is in place to translate the incoming documents into a format the receiver’s ERP system will understand.

It is worth noting that not all Peppol access points offer the same service, however. For example, not all providers are yet AS4 compliant. Further, many do not offer API connection, which provides a number of significant benefits including vastly improved data visibility and simple error resolution.

2) Hermes

To complement Mercurius, the Belgian government has also developed a platform called Hermes that translates Peppol BIS documents into human-readable form (XML in PDF format) and sends them via email.

As with sending invoices directly via Mercurius, this method still requires manual effort from the receiver in order to process the invoice and therefore does not allow them to benefit from the advantages of full automation. However, it was believed that by providing such a platform, public bodies would be faster to transition to e-invoicing.

E-invoicing in Belgium – The situation today

Today Mercurius is used (directly or indirectly via Peppol) by around 25,000 economic operators and close to 2,000 contracting authorities. Over a million invoices have already been sent via the platform.

What is the future of e-invoicing and EDI in Belgium?

As Belgium now mandates that suppliers provide electronic invoices for all B2G transactions, the country is further along in terms of B2G automation than many other European countries.

Given the benefits experienced by organisations (both suppliers and customers) upon switching to e-invoicing, many of these businesses are now looking to extend the automation of data exchange to other document flows, such as ordering. In fact, at time of writing the Flemish government is already testing a new e-Ordering pilot scheme.

As more and more public and private organisations gain the capacity to exchange structured electronic documents, EDI and e-invoicing in particular will undoubtedly become increasingly popular in B2B as well as B2G exchanges. In short, with an ever-growing percentage of supply chains dependent on automated message exchange, life is set to get harder for those organisations that resist making the forward-thinking move to adopt EDI.

Want more information on e-invoicing in Belgium?

At ecosio we are experts in e-invoicing and have helped thousands of companies to experience the benefits of structured document exchange. If you would like more information on e-invoicing in Belgium, please contact us today. We are more than happy to provide additional information regarding what you need to do to ensure your business is capable of meeting current regulations.

You may also be interested in our blog articles on e-invoicing in…

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator. To try it out yourself just click here.