Background

Due to the increasing spread of electronic invoices, the Republic of Hungary is now also relying on the use of electronic invoices (via the NAV system). The aim is to facilitate the reporting of VAT-related data to companies, increase transparency for invoice issuers, invoice recipients and the Republic of Hungary and, finally, fight sales tax fraud.

Those affected by the new law in Hungary are:

- Hungarian companies

- Foreign companies with a branch in Hungary

- From July 2020, anyone who issues an invoice to another domestic taxable person where the transaction is carried out in Hungary (regardless of VAT content)

For businesses, this means that invoices must be reported electronically through a centralized system. Invoicing data are transmitted electronically in XML format to the Hungarian NAV system. For companies that cannot generate XML documents, there is also a web-based interface available, via which the invoicing data can be entered manually. Due to the manual processing, the web interface is only convenient with a very small invoice volume.

The notification to the Republic of Hungary must be made within three days – and ideally directly after the invoice is created.

Technical Realisation

Invoices are sent to the NAV system in Hungary via a web service, whereby the invoice data must be transmitted in XML format. The official NAV website of the Republic of Hungary provides a detailed technical description of the web service as well as the XML schemas.

Website of the NAV system

The information is available in Hungarian, English and German, although not all parts of the website have been translated into English and German.

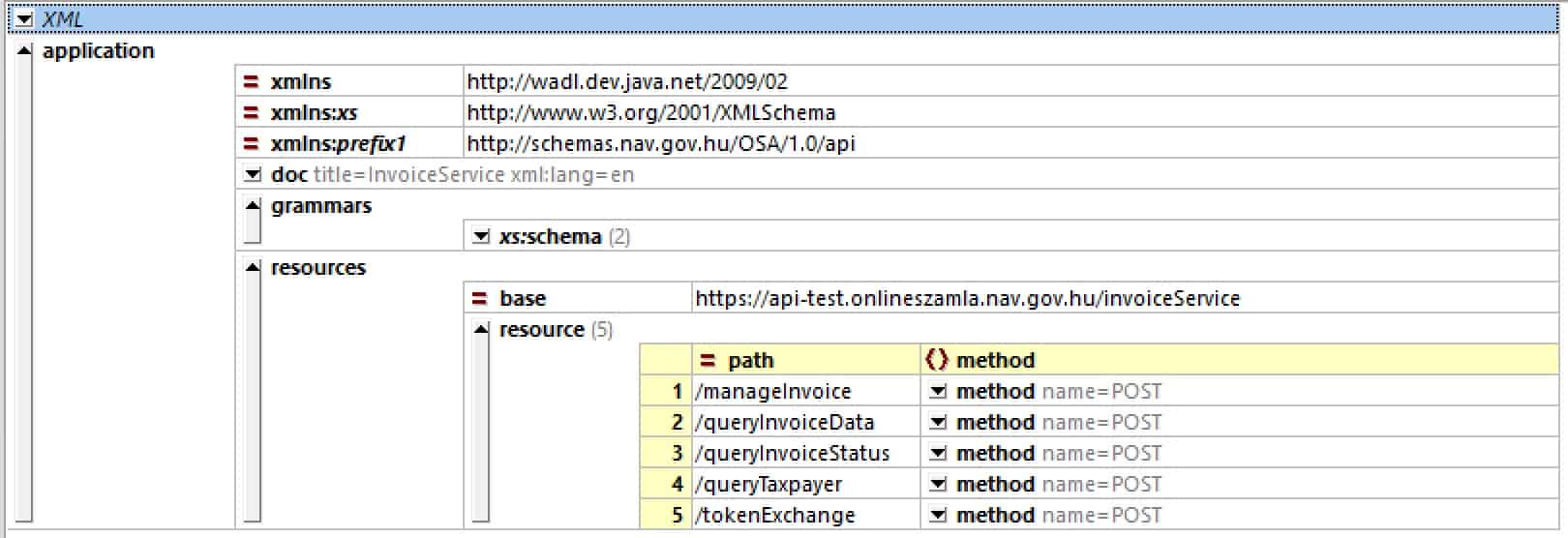

A look at the WADL file shows the methods offered by the Web service:

Web service operations of the NAV system

As can be seen, all communication is handled using HTTP POST operations. RESTful purists may raise their eyebrows at this.

The exact sequence of the individual web service calls and the code examples in Java can be found in the Technical Guide on the NAV website.

Transmission from the ERP System

When automatically transferring invoice data to the NAV system, the invoice data is taken directly from the ERP system. This means that in addition to issuing a regular invoice, an invoice artefact for the NAV system must be generated. For this, a corresponding copy control must be set up in the ERP system.

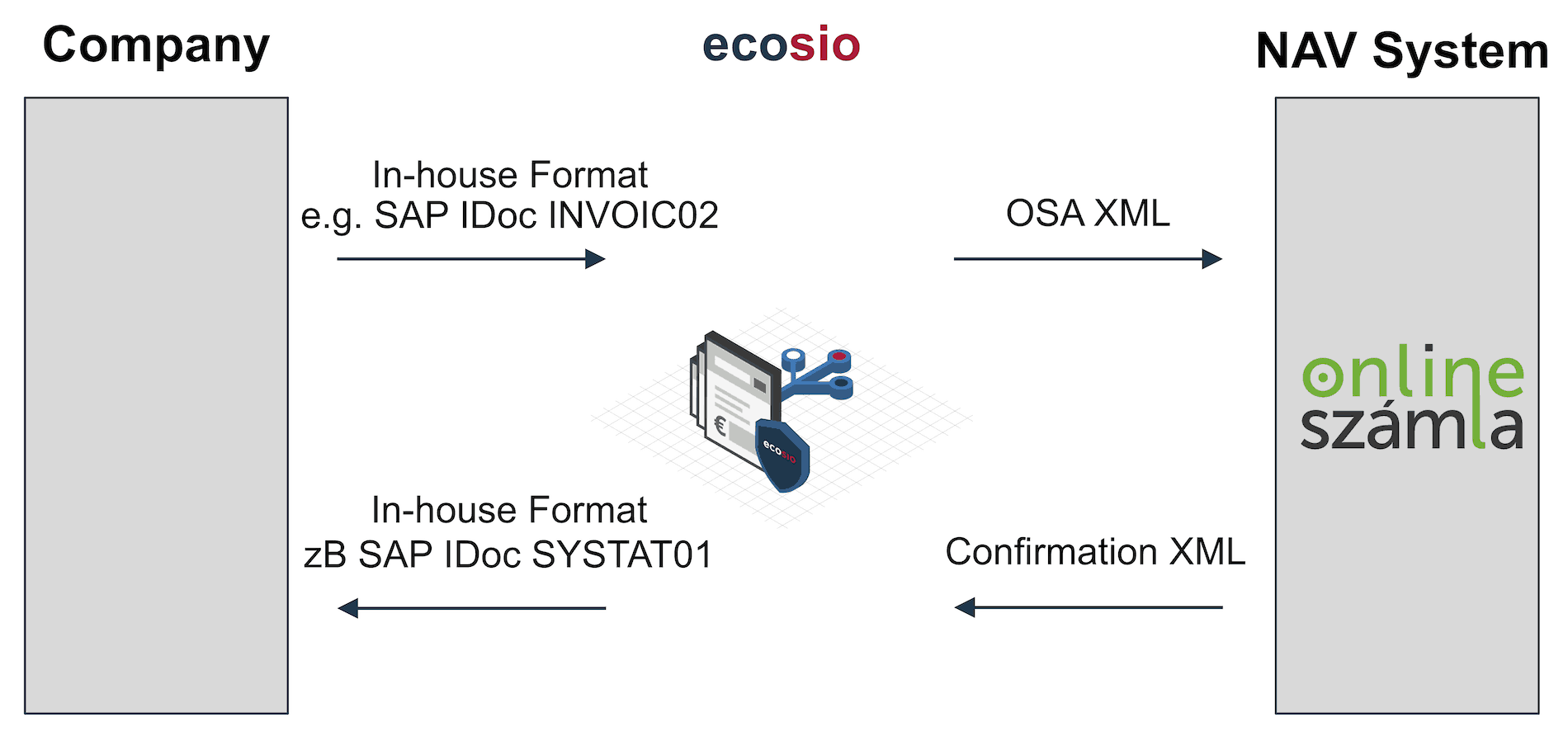

As shown in the following figure, the invoice document is transferred to ecosio in the ERP export format (e.g. IDoc in the case of SAP). ecosio converts the ERP export format into the desired target format of the NAV system, according to the official OSA XML schema. Subsequently, the invoice document is transmitted.

Transfer of data from the ERP system

The Web Service returns a confirmation message about the processing of the delivered invoice as an XML document. This XML document is converted by ecosio into a message state (invoice successfully transmitted, or invoice not successfully transmitted) and, if desired, can also be sent back to the ERP system as a separate XML document.

In the case of an SAP system, a confirmation can, for example, be based on a SYSTAT01 IDoc, which can be used to change the status of the originally transmitted invoice IDoc (for example, to status 41 – application document created in the target system).

Depending on the ERP system, the integration can be implemented as desired, allowing feedback in Microsoft Navision / Dynamics, Oracle, abas ERP, etc.

Registration

To file invoices in accordance with the Hungarian legislation, registration via the NAV system is necessary.

For companies from the DACH area, this means that the representative of the Hungarian branch must complete this registration and then create a technical administrator in the system. Using the access data of this technical administrator, an EDI service provider such as ecosio can then carry out the next setup steps and start the tests.

Developers have their own test platform available.

Questions?

Do you still have questions about e-invoicing in Hungary or are you looking for a solution to automatically transfer invoicing data to the NAV system? Please contact us or check out our chat – we are happy to help!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator. Try our free Peppol tool out yourself.