Electronic invoicing, usually referred to simply as e-invoicing, is becoming increasingly popular internationally in both the B2B and B2G sectors, gradually replacing the old-fashioned paper invoice and more recent PDF invoice. In recent years this has been accelerated by European legislation mandating the use of e-invoicing in B2G transactions (as explored in detail in our white paper on this topic) as a result of the benefits of e-invoicing becoming more well known.

On the one hand, this shift naturally means a change in invoicing processes – something that some may view with trepidation. On the other hand, however, e-invoicing brings many advantages to supply chain businesses. In this article we’ll explore these briefly in the context of the other commonly-used alternatives.

Paper invoicing

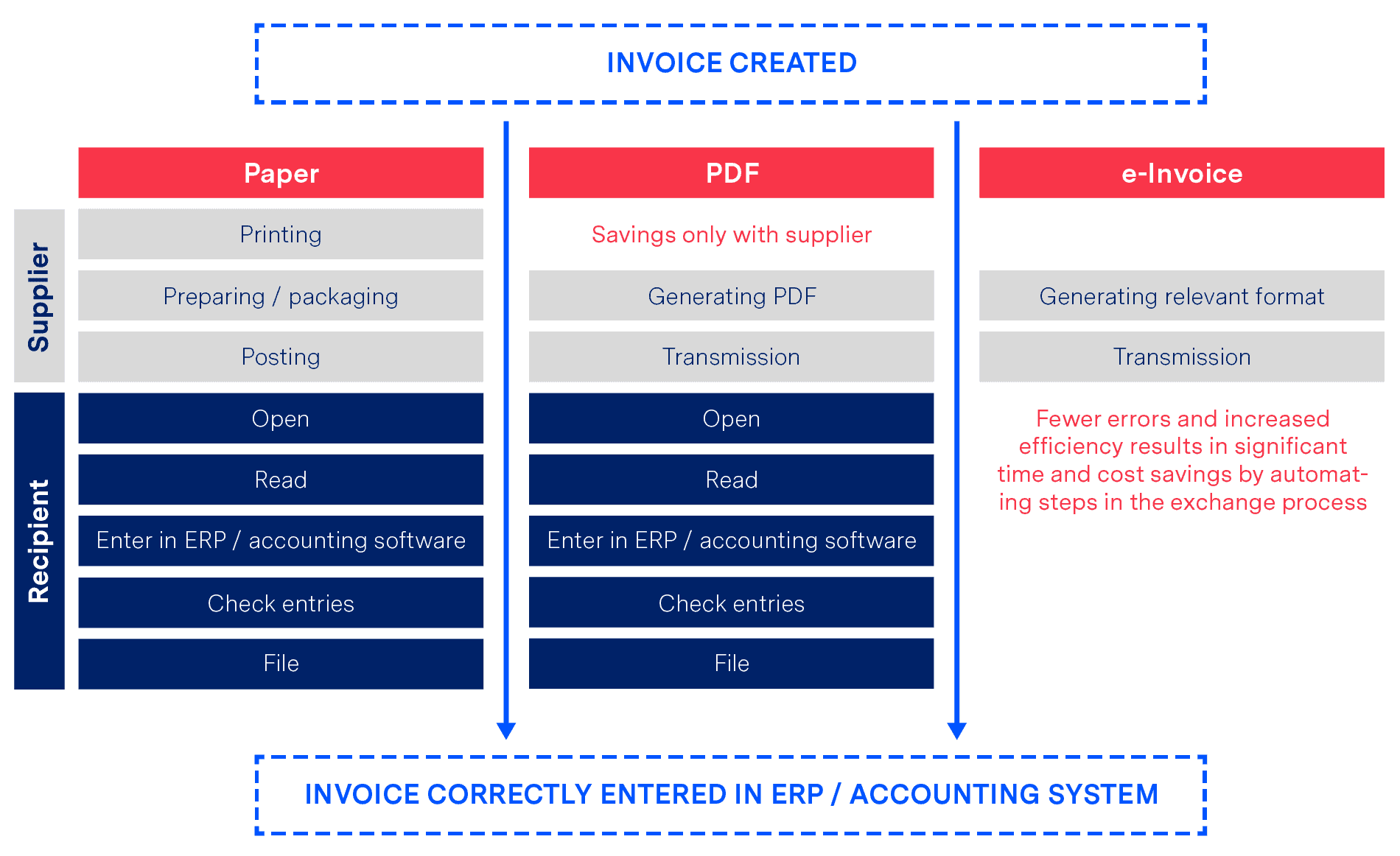

Surprisingly, paper invoices still make up a large percentage of the invoices exchanged today. Yet as the diagram below shows, this method is not only consumption heavy, it also requires significant effort compared to the alternative (e-invoicing).

The sender prints out the invoice, puts it in an envelope, stamps it and then posts it. However, the costs incurred are not limited to those relating to postage. Rather, it is the manual processes of invoice creation, which are reflected in personnel and infrastructure costs, that make the paper-based process expensive. Anyone who has ever written several invoices will be able to understand how complex and non-scalable paper-based invoicing is!

Interestingly enough, many also trust the post office “blindly” when sending invoices, simply assuming that the invoice will reach the recipient (which in most cases it does of course). However, a confirmation of receipt by the recipient is only available with the classic paper invoice for an additional charge.

PDF invoicing

Over the past decade more and more companies have moved from paper invoicing to PDF invoicing. This is due in part to the legal equivalence of the e-invoice with the paper invoice and the omission of the obligatory electronic signature. Instead of sending paper invoices, PDF documents are sent by email or offered for download. The latter option is mainly used in the B2C sector – e.g. when downloading the telecom bill.

For the sender of a PDF invoice, effort is reduced to the generation of the PDF (which is usually done automatically from the IT system) and the dispatch (which is also mostly done automatically). Admittedly this represents a significant improvement compared to paper invoicing.

However, the process is still problematic on the recipient’s side as they are still confronted with a media break, as with a paper invoice. In other words, the data cannot be transferred automatically from the PDF into the ERP/accounting system. Instead, the recipient is required to type it in manually or transfer it using copy & paste.

The reason for this is the PDF format itself. Unfortunately many people mistakenly believe PDF invoicing comes under the banner of e-invoicing. However this is not the case as a PDF is not a structured, machine-processable document format, but is instead designed to be human-readable. Formats such as XML, CSV or EDIFACT are far more suitable for automated document exchange.

E-invoicing

When an e-invoice is sent, the invoice is generated on the sender’s side in a machine-processable format (e.g. EDIFACT or XML) and then sent directly to the recipient’s IT system. There the e-invoice is absorbed by the IT system without human intervention and is immediately available for further processing (e.g. invoice verification and approval).

In contrast to paper or PDF invoices, no manual steps need to be taken and the process can be fully automated.

Furthermore, the sender (depending on the technical protocol used for invoice transmission) receives a corresponding confirmation as soon as the recipient has received the invoice.

So how do these methods compare in real terms?

The diagram below shows the steps involved in the sending and receipt of different types of invoice:

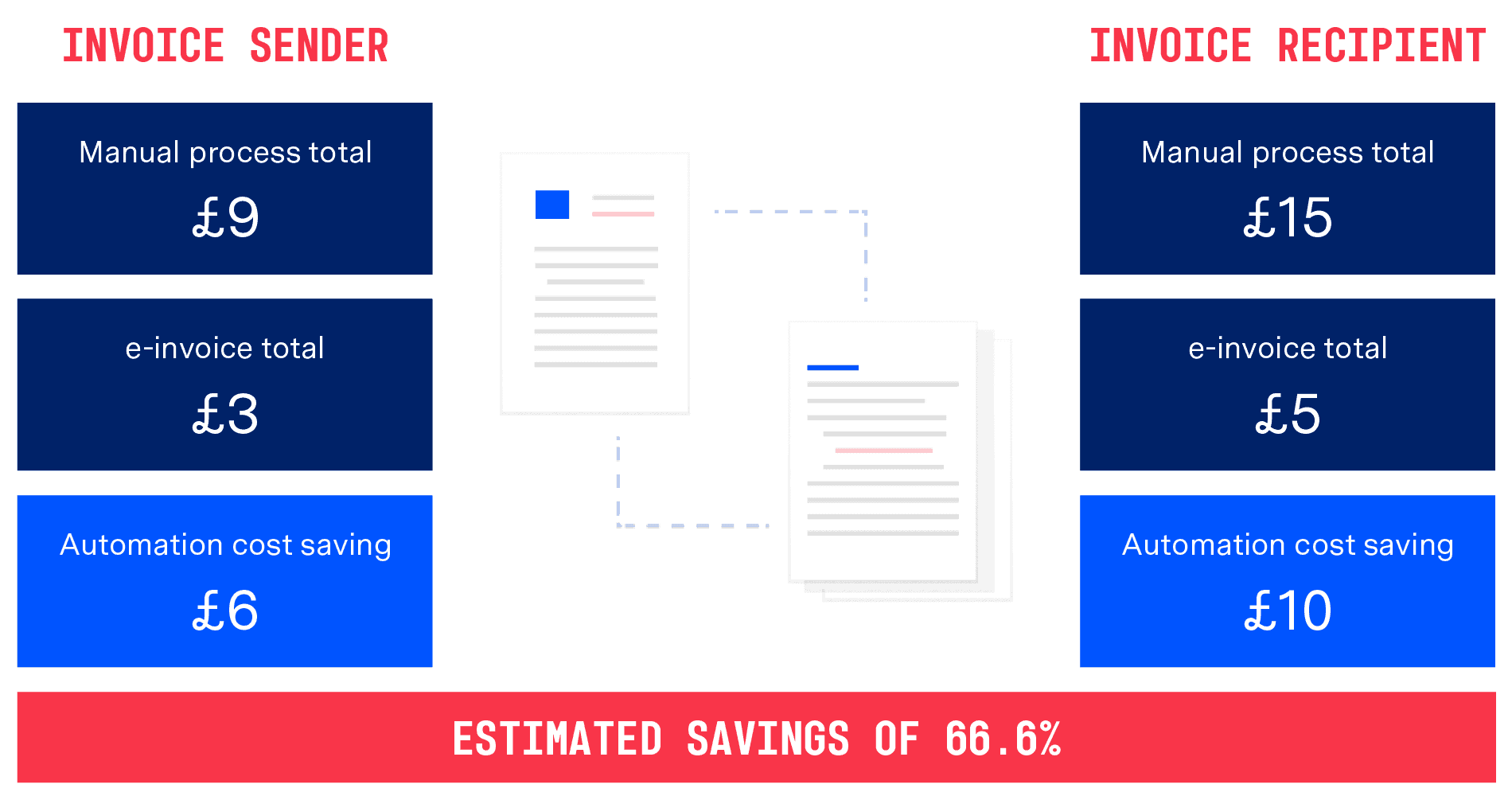

Predictably, the reduced steps also have a sizeable impact on cost. Based on numerous reports from IBM, GS1, EY and others the average cost for a company to process a single document manually is roughly around £15. These calculations consider FTE costs, opportunity costs of more value-adding activities, errors, delays and postage/fax fees (if relevant).

With an efficient EDI system in place the cost to send and receive an invoice can be reduced by two thirds!

The benefits of e-invoicing at a glance

So what are the specific benefits of using e-invoicing?

- Savings in time, shipping and personnel costs

The tedious paper-based invoicing process, from printing to postage, is completely avoided. Personnel who were previously responsible for invoicing can now be assigned to other activities. The company can concentrate on its core business again and doesn’t need to spend resources on complex support processes such as accounting. The recipient in turn is relieved from manually processing the received invoice, as the invoice data can be automatically transferred to the ERP/accounting system. - Reduced material costs

Costs for paper, printer, enveloping etc. are reduced. - Faster payment due to faster processing

The payment periods for invoices usually begin to run upon receipt of the invoice. As an electronically sent invoice is immediately available to the recipient, earlier and (hopefully) timely payments are the result. - Reduction of input errors

With the continuous automation of the invoicing process and the elimination of manual intervention, input errors are reduced to a minimum. - Simplification of archiving

According to legal regulations, companies must store invoices for future audits by the tax authorities. The length of time varies from country to country (usually between 5 and 10 years). Paper invoices are generally not well suited for long-term storage. Fire or water damage to the archive can potentially result in the loss of archived invoices. Consequences for the company in such cases can be very expensive – the tax authorities then typically start to estimate – mostly not to the advantage of the company. In the case of electronic invoice transmission, the invoice data is already available in electronic form and can therefore be very easily integrated into an electronic archiving system. With appropriate backups and data mirroring (which are standard in contemporary archiving systems), invoice data remains secure and available. - Less paper consumption

How ecosio can help

At ecosio we are experts in e-invoicing and were one of the first certified Peppol access point providers in Europe. Our team of EDI experts is well equipped to help your business benefit from automated invoicing not only with public bodies, but across your supply chain as a whole.

Uniquely, at ecosio we take care of virtually all the work necessary to allow you to trade structured electronic documents with your business partners. Unlike other so-called ‘managed’ solutions which offer customers minimal assistance when it comes to setup, testing, maintenance and error handling, ecosio offers a fully managed service, resulting in maximum efficiency with minimal internal effort. Every customer is assigned a dedicated project manager who will oversee implementation and ongoing operation of the solution, ensuring a successful outcome.

Your advantages with ecosio

- Compliance – No need to worry about e-invoicing regulations

- Cost-saving – Replace cost heavy manual processes with efficient automation

- Flexibility – Modular supply chain solutions to suit your needs

- Future-Proof – Automatic implementation of updates and renewal of certificates

- Peace of Mind – Comprehensive support and 24/7 monitoring

- Ease of Use – Direct integration in your ERP system via API

- Simplicity – One connection for all EDI partners

Find out more

To find out more about ecosio’s e-invoicing solution and how we could help you to experience the benefits of e-invoicing, get in touch today!

Chat with us