Thanks largely to EU directive 2014/55/EU e-invoicing has become a topic of particular concern for many countries across Europe in recent years. As elsewhere, in Poland one of the main reasons for promoting e-invoicing is to help combat tax fraud. In particular, Poland has been very successful in analysing the so-called VAT gap (the gap between expected VAT and actual VAT) and setting out the necessary measures to reduce it. As a result, as we shall explore in this article, Poland is planning to go further than many other countries when it comes to e-invoicing.

Before looking at planned changes regarding e-invoicing in Poland, though, let’s first look at the current regulations…

E-invoicing in Poland – Current status

Like other countries, Poland is currently using an online portal to facilitate the transmission of e-invoices between private companies and public entities. This platform, “Platformy Elektronicznego Fakturowania” (simply known as PeF), was launched on 1 April 2019.

Since 18 April 2019 all sub-central Polish public entities have been required to register on this platform and be ready to receive structured electronic invoices (in Poland there is no difference in requirements for central and non-central public entities).

In 2020 Poland chose to replace its traditional VAT system with one requiring a Standard Audit File for Tax (SAF-T). This has been mandatory since July of 2020, with taxpayers required to submit SAF-T reports to the Polish Tax Authority every month. Previously all businesses had been required to submit both SAF-T reports and traditional VAT returns. Reporting via SAF-T is not real-time, however, and does not involve automated sending and processing, which is why Poland are now looking to move towards e-invoicing.

What standards are required?

Unlike some other European countries, Poland has not created its own national Core Invoicing Usage Specifications (CIUS). Instead, Poland uses standard Peppol – specifically Peppol BIS Billing 3.0. Essentially this is virtually the same as the basic Peppol BIS 3.0, but it has been supplemented with relevant Polish terminology.

As long as invoices are compliant with EN-16931 and Peppol BIS Billing 3.0, all registered Polish public bodies should be able to receive electronic invoices from other Peppol-connected companies.

E-invoicing in Poland at a glance

| Standards | Mandatory? | Platforms | Length of archiving required |

| UBL 2.1

UN/CEFACT CII Peppol BIS Billing 3.0 |

Yes for B2G – Public bodies must accept e-invoices | PeF | 5 years |

Upcoming changes

As recently clarified by the Polish Minister of Finance, in the coming years Poland is looking to follow Italy and move towards mandating e-invoicing and e-reporting for all transactions, not just those involving public bodies.

“Currently, public administration units, i.e. awarding entities, cannot refuse to accept e-invoices from contractors. For entrepreneurs, e-invoicing is voluntary. […] Italians followed a similar path, and they also started with the implementation of e-invoices in relations between administration and business. When this solution worked, they made it available to business.”

From July 2024 all B2B invoices (with some minor exceptions) must be issued and received for approval via the national e-invoicing system “KSeF” (Krajowy System e-Faktur) – using the Faktura format. KSeF started on 1 January 2022 and offers structured e-invoicing on a voluntary basis from that date. However, from July 2024, use of KSeF will become legally mandatory, replacing the current SAF-T system of monthly reporting.

Significantly, invoices will be transmitted to KSeF via a dedicated API and not via Peppol, as is the case in other European countries such as Croatia or Serbia. KSeF will keep the e-invoices for a period of ten years (more information can also be found on the official site of the Ministry of Finance in Poland). Users will be able to view invoices via a special platform.

How can I meet current and upcoming e-invoicing regulations in Poland?

Given the planned changes, those wanting to do business in Poland will need an e-invoicing solution moving forwards. Meanwhile businesses operating internationally will require flexible, future-proof solutions that are capable of adapting to and coping with the growing number of countries bringing in legislation relating to e-invoicing.

Whilst there are many different ways of gaining the capacity to send and receive e-invoices, these can be distilled into two main categories: handling in-house or outsourcing to a service provider.

- Handling in-house is typically an option for larger companies who have the necessary expertise and resource power to plan, implement and maintain a solution.

- Outsourcing to a service provider, on the other hand, is typically well suited for businesses that lack the necessary resources and are looking for a simple, efficient and future-proof solution. In particular, a fully managed solution (such as ecosio’s) will allow you to meet requirements with minimal internal effort, leaving in-house teams free to focus on more value-adding activities.

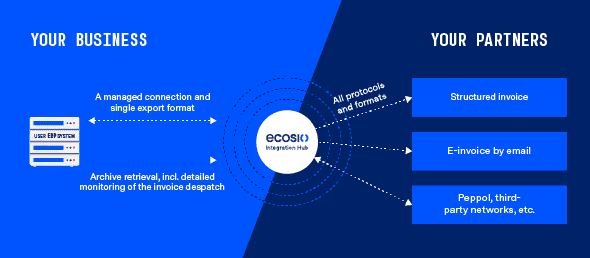

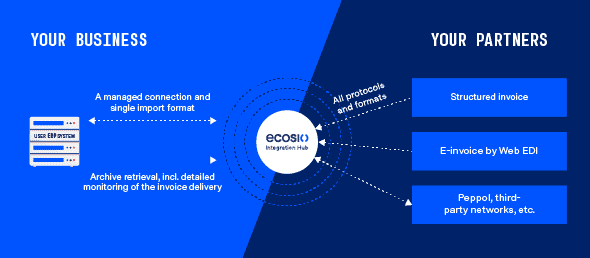

The images below demonstrate how ecosio’s fully managed solution works regarding sending and receiving e-invoices.

Things to bear in mind when making a decision:

- Realising a technical connection can be challenging and requires significant expertise. In particular Poland’s choice to use Peppol requires a company to operate a Peppol compliant access point in order to send and receive e-invoices. However, similar to procuring an email service from Microsoft or Google, instead of running an inhouse mail server system, a Peppol access point is usually procured from an external service provider “as a service” and not run inhouse.

- Your requirements (and those of your partners and the countries you operate in) are likely to change over time

- If you do not currently exchange any information with partners via electronic data interchange (EDI), it may make sense to consider implementing a solution beyond simply e-invoicing (as the resultant savings can be significant)

Exporting e-invoices with ecosio

Importing e-invoices with ecosio

The wider picture

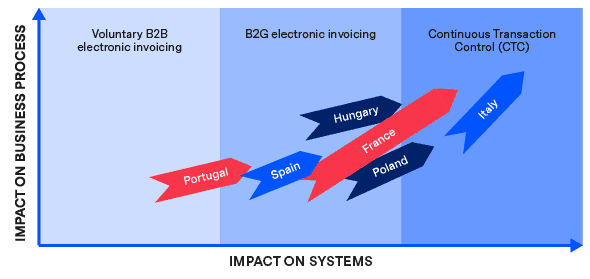

As shown in the image below, Poland is one of a number of European countries that are taking large steps towards mandatory e-invoicing across the board – known as “continuous transaction control” (or CTC).

Thanks to the many benefits of e-invoicing for sender and receiver (from increased speed of payments to a reduction in manual effort and significant operational savings), other countries are expected to follow suit in the years to come. In particular, more and more governments will be keen to roll out extensive e-invoicing/e-reporting measures to increase the visibility of tax data and crack down on tax avoidance/fraud.

E-invoicing – The trend towards CTC

As a result, even if you do not yet need an e-invoicing solution, you may well do soon – particularly if you wish your business to grow and avoid supply chain complications in the future.

Want more information?

At ecosio we have helped thousands of businesses to implement efficient e-invoicing solutions. Our e-invoicing experts can help you to implement a solution no matter what your ERP system, so you can start to experience the benefits of supply chain automation. What’s more, ecosio’s fully managed solution ensures in-house teams are free to focus on more value-adding activities, safe in the knowledge that message exchange is in good hands. We don’t just set up your connections, we work to ensure continued success, moving proactively to resolve issues as soon as they arise.

For more information on how we can help you meet current (and future) e-invoicing regulations in Poland and for advice on what practical steps you can take towards wider automation please contact us. We are always happy to answer your questions.

More information on e-invoicing can also be found here.

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.