Thanks mainly to the EU Directive 2014/55/EU, e-invoicing has become a topic of particular interest for many European countries in recent years. In Poland, too, one of the main reasons for promoting e-invoicing is the fight against tax fraud. Poland has been particularly successful in analysing the so-called ‘VAT gap’ (the gap between expected and actual VAT) and has been proactive in identifying the necessary measures to reduce it. As a result, as we will explore in this article, Poland plans to go further than many other countries when it comes to e-invoicing. This article serves as an overview of the current situation of B2G and B2B e-invoicing in Poland.

Update: Postponement of Mandatory Electronic B2B Invoicing in Poland to 2026

Poland is in the process of further optimizing its national e-invoicing system, Krajowy System e-Faktur (KSeF). Recent discussions and announcements have revealed significant changes and timelines.

The Polish Ministry of Finance has confirmed a phased approach for the mandatory implementation of KSeF:

- February 2026: Mandatory for “large taxpayers” (companies with an annual turnover exceeding 200 million PLN in 2025)

- April 2026: Mandatory for all other taxpayers

This revised timeline provides businesses with additional time to prepare for the mandatory electronic invoicing.

E-invoicing in Poland: B2G

Like other countries, Poland is currently using its own online portal for the B2G sector to facilitate the transmission of e-invoices between private companies and public bodies. The “Platformy Elektronicznego Fakturowania” (or simply PeF) was launched on 1 April 2019.

Since 18 April 2019, all sub-central Polish public entities are obliged to register on this platform and must be able to receive structured electronic invoices (in Poland, there is no difference in the requirements for central and non-central public entities).

Poland has also become active early in the area of electronic VAT reporting. 2016 Poland decided to replace its traditional VAT reporting system with one that requires a Standard Audit File for Tax (SAF-T). Since 2020 it has been mandatory for affected businesses to submit SAF-T VAT return reports to the Polish tax authority every month. Previously, all businesses had to submit both SAF-T reports and traditional VAT returns. However, SAF-T reporting is not real-time and does not involve automated dispatch or processing, which is why Poland now plans to switch to e-invoices in the near future.

What standards are required?

Unlike some other European countries, Poland hasn’t created its own national Core Invoice Usage Specification (CIUS) in the B2G area. Instead, Poland uses the standard format based on EN16931 and Peppol BIS Billing 3.0.

As long as invoices are compliant with EN16931 and Peppol BIS Billing 3.0, all registered Polish public entities should be able to receive electronic invoices from other Peppol-connected entities.

E-invoicing in Poland at a glance

| Standards | Mandatory? | Platform |

| KSeF XML Schema | Yes, for B2B from 2024; use on a voluntary basis from 1 January 2022 | KSeF |

| UBL 2.1UN/CEFACT CII

Peppol BIS Billing 3.0 |

Yes for B2G – public bodies must accept e-invoices | PeF |

How to achieve compliance with current and upcoming e-invoice regulations in Poland

Those who want to do business in Poland need a solution for e-invoices that is future-proof. Internationally active companies in particular need flexible solutions that can adapt to the growing number of countries introducing e-invoice legislation.

As with regular electronic data interchange (EDI), it is in principle possible for internal teams to handle e-invoicing according to Polish regulations. This can be difficult, however. Not only do internal teams have to set up connections for e-invoicing; they are also responsible for ensuring everything runs smoothly and for providing the necessary support when errors occur. Furthermore, the requirements for interfaces and formats used change regularly, as the examples of Italy and Hungary show. These requirements can be tedious and time-consuming and put a strain on internal teams. Using Peppol instead of web services or SFTP (if technically permissible) can simplify the process, but this too has specific requirements, such as the necessary connection to a Peppol access point. In addition, if your company exchanges a large number of invoices, has many partners or also operates in additional European countries, handling e-invoicing internally becomes increasingly difficult.

If an efficient e-billing solution is to be implemented without interrupting your business operations, the process needs to be managed by someone who knows exactly what is required. For most businesses, therefore, the simplest, most future-proof and ultimately most cost-effective solution is to use an experienced service provider like ecosio, who can handle the transition fully and manage your e-invoicing solution for you.

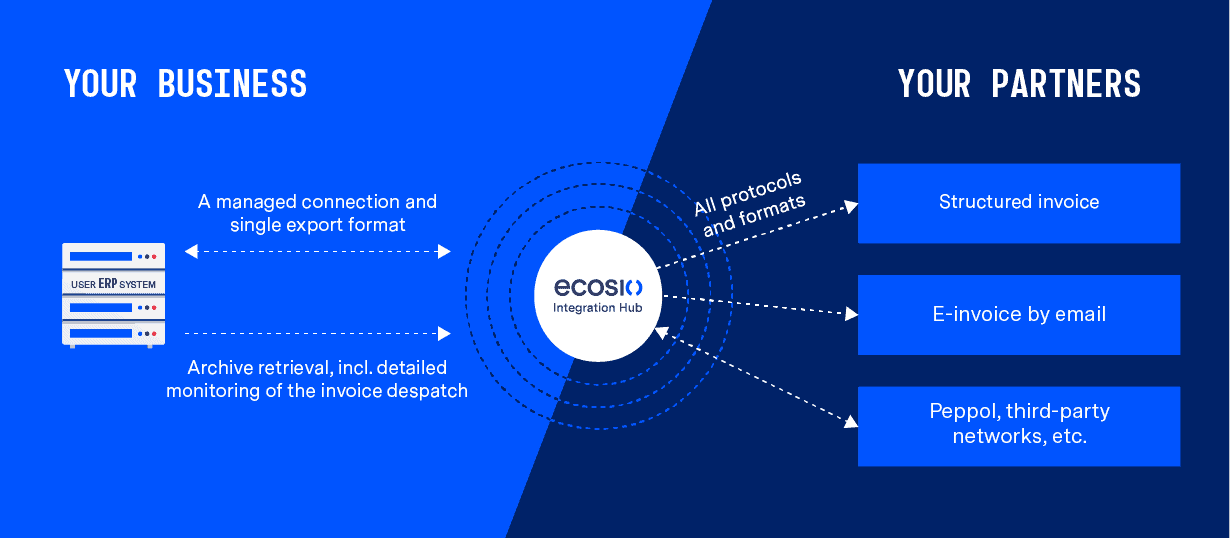

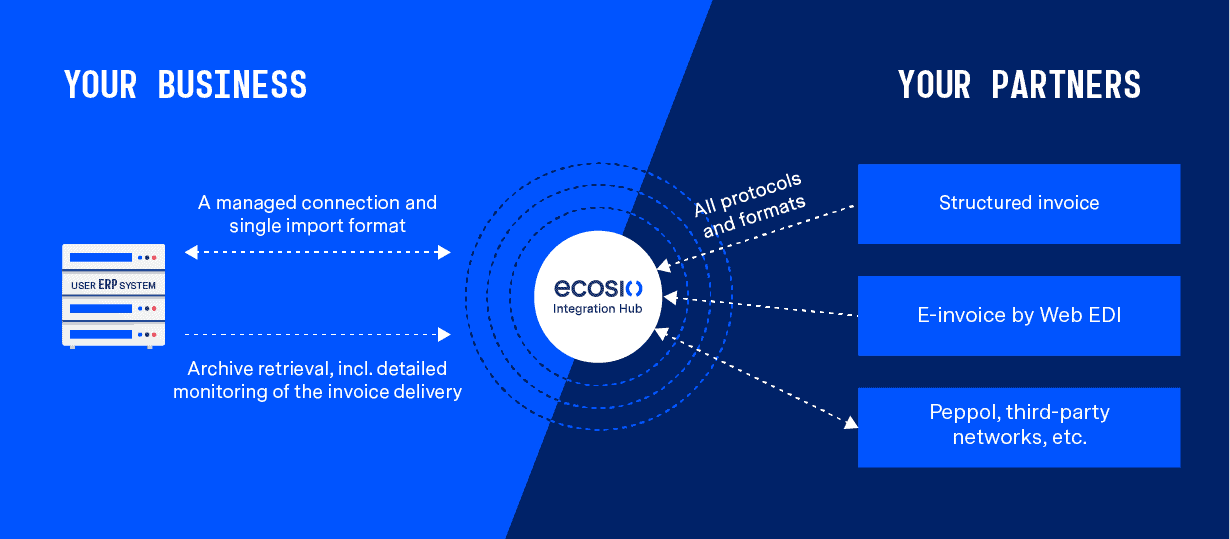

The graphics below show how the import/export of e-invoices works with ecosio.

Sending e-invoices with ecosio

Receiving e-invoices with ecosio

The bigger picture

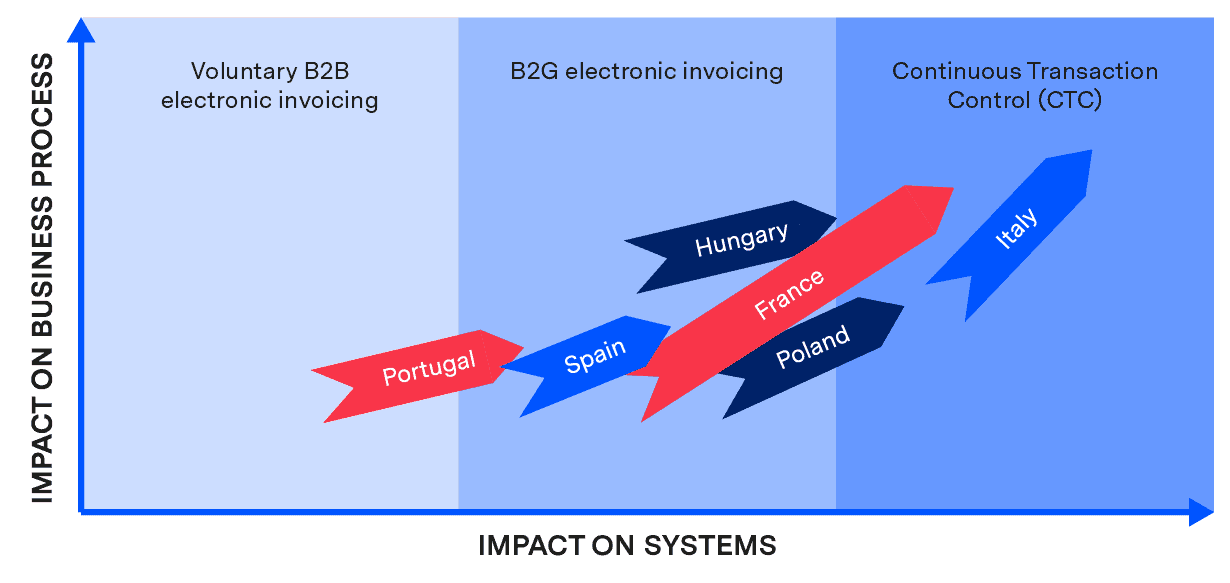

As can be seen in the figure below, Poland is one of several European countries making steps towards mandatory e-invoicing across the board – known as Continuous Transaction Control (or CTC).

Thanks to the many benefits of e-invoicing for both senders and recipients (from increased speed of payments to reduced manual effort and significant operational savings), other countries are expected to follow suit in the coming years. In particular, more and more governments will be interested in introducing comprehensive e-invoicing/e-reporting measures to increase the transparency of tax data and to fight tax avoidance/fraud.

E-invoicing: The trend towards CTC

E-invoicing offers advantages not only to governments and their tax offices, but also to the companies that use them. For more information on the specific benefits you could experience, why not download our stat-packed, printable infographic?

Want more information?

At ecosio, we have already helped many companies implement efficient e-invoicing. Our e-invoicing experts will help you implement a solution, independent of your ERP system, so that you can immediately reap the benefits of automation. ecosio’s EDI as a Service offering ensures that your internal teams can focus on more value-adding activities – safe in the knowledge that message exchange is in good hands. We don’t just set up your connections, we work to ensure ongoing success and proactively resolve issues as they arise.

If you would like to learn more about how we can help you meet e-invoicing regulations in Poland (both current and future), please contact us. We are always happy to answer your questions.

You can also find more information on e-invoicing here.

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.