The development of the e-invoice

Before exploring the complexities of the SAP eDocument framework, let’s first consider the development of the e-invoice over recent years. In the past it was common practice to send paper invoices by post or fax. But since then, invoices have usually been created and transmitted digitally, for example as PDF documents that are sent by email. In the course of digitisation, the need for automation of existing processes is increasing. For this reason, and due to legal regulations, more companies are switching to e-invoices, which can be created, sent and processed automatically. Invoicing is carried out fully automatically using a structured exchange format (e.g. XML) between the IT systems of the participating companies – without any human interaction. This process not only saves time and money, but also reduces the likelihood of errors.

Governing institutions are increasingly focusing on e-invoices, which must be created in a certain processable format. This started primarily in Latin America to combat tax fraud. Since the use of the regulations has proven itself successful and authorities can thus act more effectively, European countries now also use similar guidelines.

The EU Directive 2014/55 / EU requires public authorities in Europe to receive and process electronic invoices. This resulted, for example, in the German CIUS (Core Invoice Usage Specification) XRechnung. The Italian Government went one step further on January 1st 2019 by obliging all companies in Italy to invoicing through the SDI system (Sistema di Interscambio). Likewise, there are already signs in Spain that the B2G e-Invoicing guidelines will be extended to the B2B sector.

E-Invoices in Use

Companies are therefore faced with the challenge of implementing various laws for sending and receiving invoices in IT systems. Depending on the country, different invoice formats are used and different transmission channels for e-Invoices are required. In particular, government institutions often rely on Web service-based approaches to transmit invoices – see, for example, the submission of ebInterface invoices in Austria or FatturaPA invoices in Italy.

Another challenge is the ongoing monitoring of e-invoice processes: were invoices created and converted correctly? Has the client received the invoice? Faulty invoices are a cause for complaint by the issuer and a well-used reason for non prompt payment.

When settling invoices through central governmental regulators (such as FatturaPA), the integrity check of invoices is already done by the authority. Invalid invoices will not be accepted and will not reach the recipient.

However, companies should focus primarily on their core business and therefore need a strategy that will allow them to work safely and efficiently for a long time, at the most up-to-date invoicing standards.

If an SAP system is used in the company as an ERP system, a component of this strategy can be the use of the SAP eDocument Framework in conjunction with the SAP Application Interface Framework (AIF). This framework is further discussed below.

SAP and e-invoicing: Overview of SAP Document Compliance

To enable SAP to better support its customers – especially in the area of e-invoicing – the eDocument Solution (also known as SAP Document Compliance) was developed for SAP ECC and SAP S/4HANA. This solution helps companies to meet the requirements of electronic invoicing in different countries.

How it works

With SAP Document Compliance, documents from logistics, sales and accounting can be converted into common e-invoice formats (e.g. XML files). In order to be able to respond to specific requirements of individual countries, the SAP Application Interface Framework (SAP AIF) can be used, which converts generated eDocuments into the required target format, such as the XRechnung for Germany or FatturaPA for Italy. In order to be able to map country-specific requirements in the AIF, “Packaged Solutions” must be imported. These build on the AIF and realise different country-specific requirements. In the case of FatturaPA, for example, these notes are to be entered separately in “Global AIF Settings & BC Sets” and “Italy-specific AIF Settings and BC Sets”.

To give the accounting system an overview of all eDocuments, SAP offers the eDocument Cockpit (EDOC_COCKPIT).

The benefit for you

As the first step in minimising the burden of issuing e-invoices, converting electronic invoices with SAP into popular formats provides a great relief for internal teams.

However…

After conversion the e-invoices must still be sent via a corresponding protocol or network (such as Peppol). In the case of government-mandated e-invoicing procedures such as FatturaPA in Italy, the exchange must also be carried out via a central service. This is not possible with the e-Document Solution alone.

In the next section we’ll look at the three available options for exchanging invoices with SAP Document Compliance…

Exchanging invoices with SAP Document Compliance – your three options

Option 1: Convert documents with SAP Document Compliance and AIF and send them via the SAP Cloud Platform

The SAP Application Interface Framework (AIF) is an SAP module for converting eDocuments into country-specific formats, such as the XRechnung. For the transmission of the created invoicing data the SAP Cloud Platform can be used, from which the invoices are forwarded to the receiver.

The SAP Cloud Platform Integration (CPI) is a communication platform with which data from SAP ERP or S/4HANA can be exchanged with other systems. Web services are used to send and receive documents and messages to external systems. To use CPI, a subscription to the service is required.

Option 2: Convert documents with SAP Document Compliance and send them via an EDI service provider

Once e-invoices have been converted to the desired target format using the AIF, they can also be sent using a service provider.

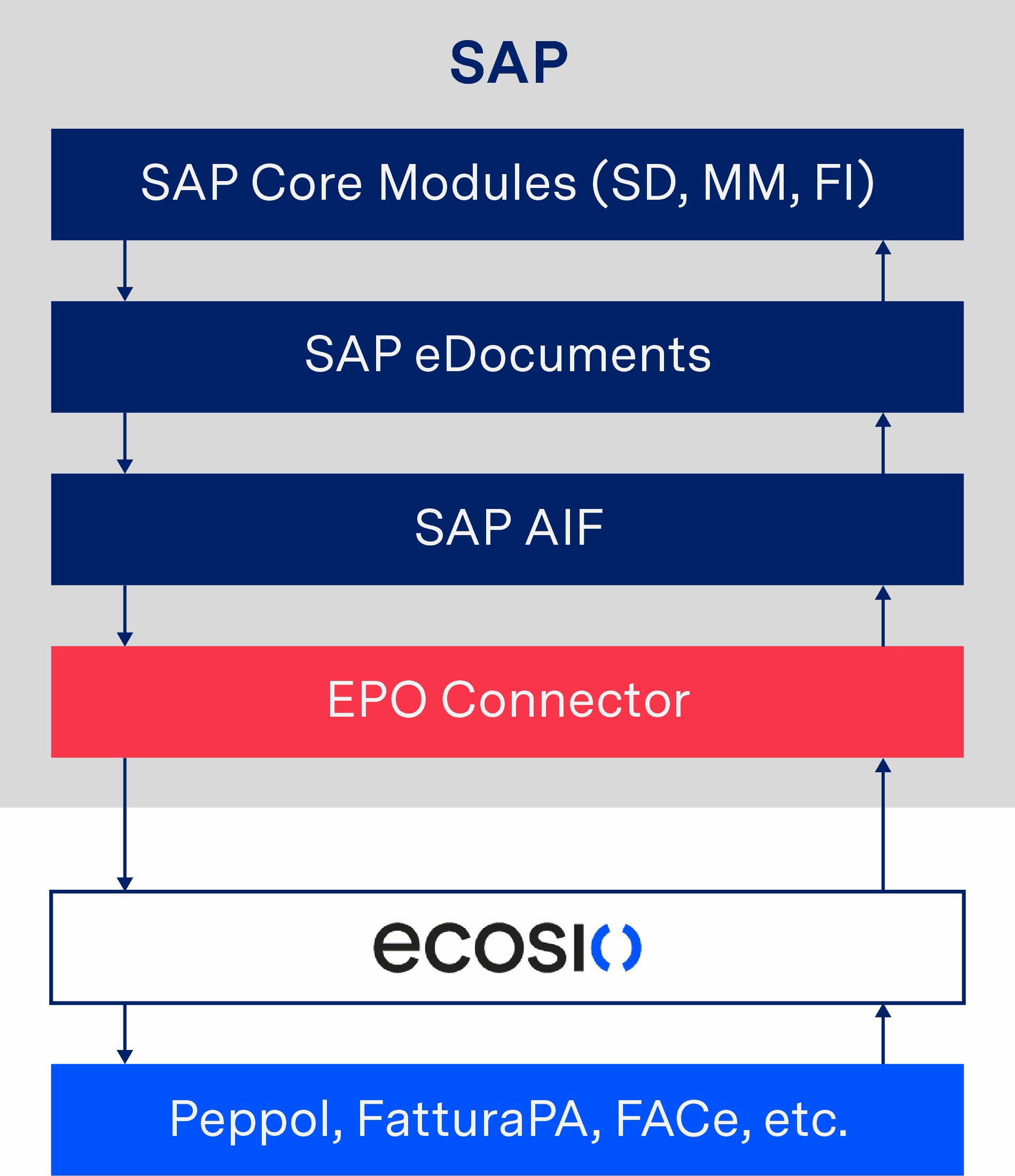

To accomplish this, middleware is needed to link the customer’s SAP system with the service provider’s software. ecosio’s EPO connector is a perfect example of a lightweight middleware that performs this function. If another SAP middleware such as SAP PI or SAP PO is available, this can also be used for the “last mile” connection to the service provider. The following figure shows the principle used.

Conversion of an e-invoice via AIF and shipping via a service provider

As soon as an invoice arrives in the service provider’s system, the required data for the delivery of the invoice is extracted, enabling the e-invoice to be sent to the recipient. In the case of XRechnung, documents are delivered to the recipient’s Peppol access point, such as a German authority. Receiving data, such as an order via Peppol, is also possible in this way.

If only the AIF is used in conjunction with the EDOC_COCKPIT, the invoices are only stored on the application server and must be manually downloaded and sent from there. With a connection to the EPO Connector, however, the dispatch and receipt of the invoices as well as the transfer of the invoicing data to and from SAP takes place fully automatically and without manual interaction. This allows complete automation of the invoicing process.

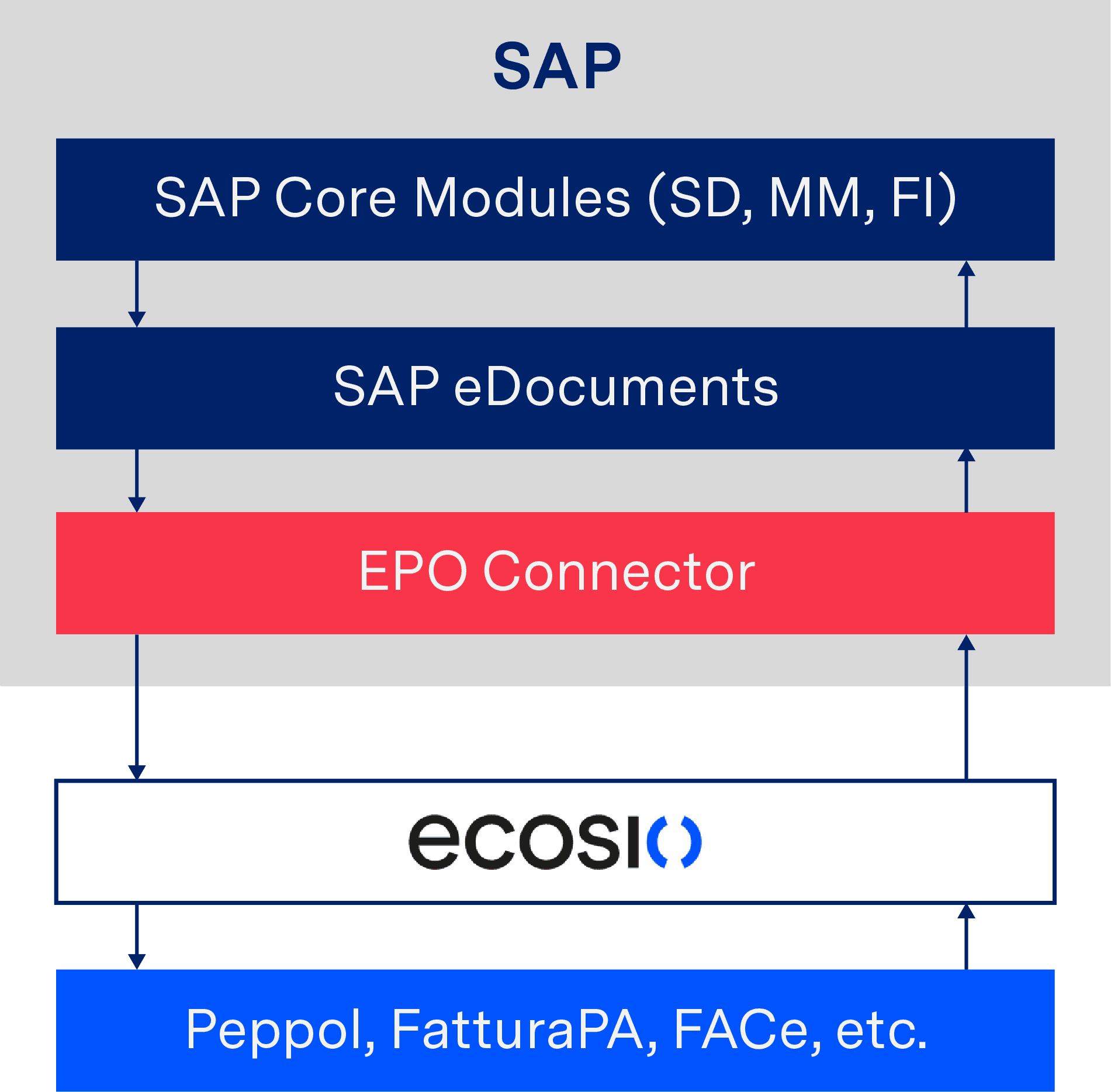

But what if you are unable to convert documents with AIF? Although SAP AIF is part of SAP Business Suite / S/4HANA and standard in modern SAP releases, to use the “SAP Document Compliance, On-Premise Edition” you need a separate license. If this is the case for you, it may make sense to consider outsourcing the conversion of eDocument formats to a service provider. If the provider is already connected to SAP ERP, the required process can be implemented particularly quickly and easily. The following example shows an integration of SAP eDocument in conjunction with the EPO Connector.

Conversion and sending of e-invoices with the help of a service provider

In this process, eDocuments are sent to the service provider via the EPO Connector, which then automatically determines the required invoice format and – if necessary – converts the document accordingly. It is then sent to the recipient as previously described.

Option 3: Use IDocs and a dedicated EDI service provider instead

The third and simplest option for internal teams involves bypassing the need to convert the documents internally (via Document Compliance) with a single connection to a fully managed service provider.

In such a solution, the provider is essentially a B2B network, creating and ensuring the success of all technical elements, such as conversion into all common and necessary formats, including e-invoicing requirements, as well as routing via various protocols, VANs and Peppol.

How this works

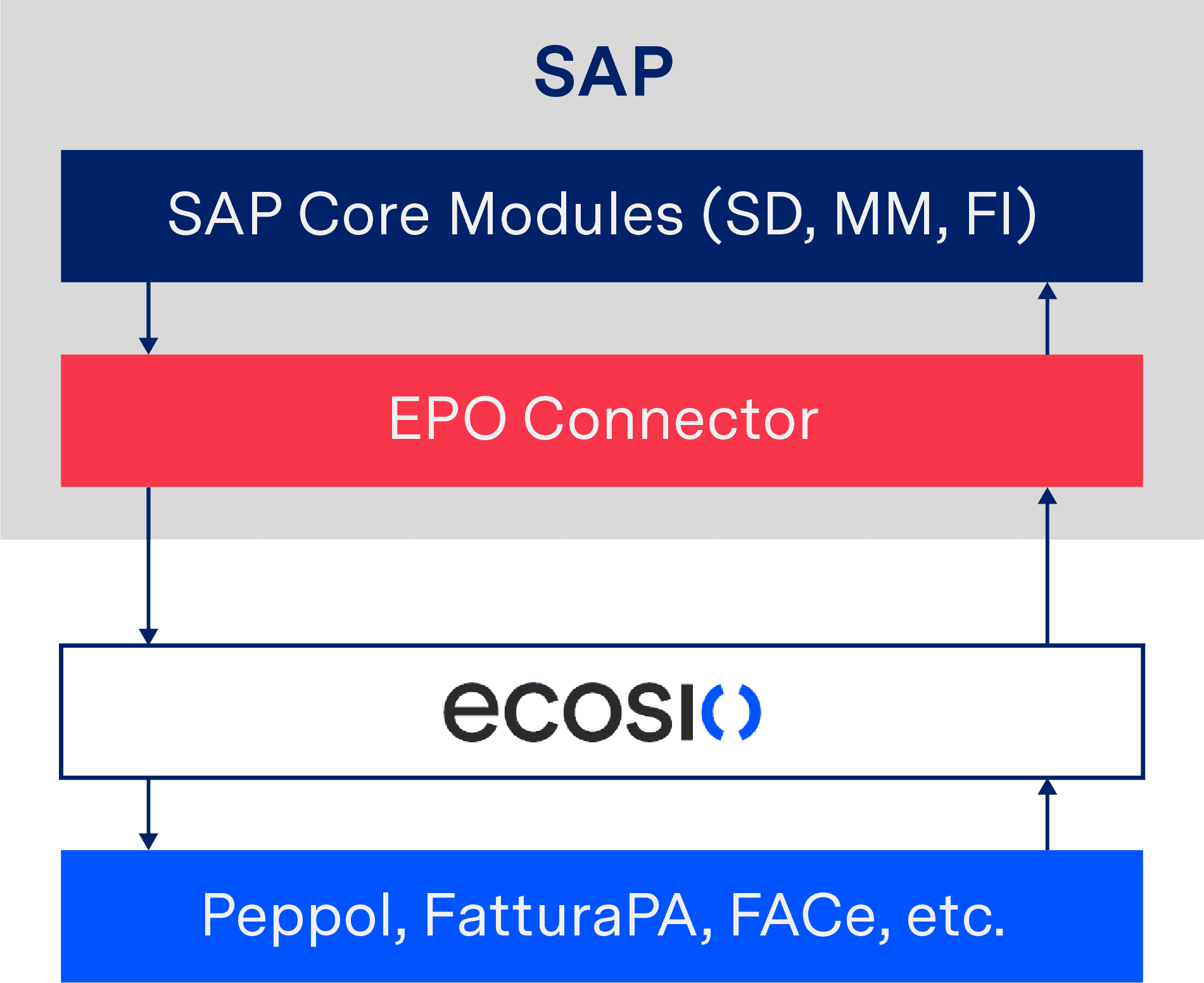

Let’s take the exchange of an invoice as an example using ecosio’s EPO connector…

Upon sending, the invoice data is transmitted directly from SAP ERP to the EPO Connector. The EPO middleware handles the conversion of the invoice into the required format and forwards the final document to your service provider. This takes care of the correct addressing and delivery of the e-invoice. The following figure shows the principle used.

Conversion of an e-invoice via AIF and shipping via a service provider

The main advantage of this approach is the financial savings.

When using the AIF solution, many SAP notes must be imported. These in turn require a large number of further manual adjustments. For SAP consultants who work on a time and material basis, this can quickly become very expensive.

By contrast, using the EPO Connector in conjunction with ecosio eliminates expensive time and material costs, allowing you to work with predictable fixed costs. The final e-invoice solution is handed over “key in hand” and the exchange of electronic invoices can be fully automated.

The most efficient way to use fully managed EDI seamlessly in the familiar user interface of SAP systems is through integration via API (Application Programming Interface). This allows you to display the status of a sent message directly on the SAP IDoc or SAP document, for example, or to perform a full text search in all documents – for more information on what this means, see the following section.

The benefits of a fully managed EDI service provider

A fully managed service provider not only takes care of the conversion and transmission of e-invoices, but also the monitoring of ongoing processes. This way invoices that do not meet the required standard can be corrected immediately. In addition, converted invoices are validated before they are sent to ensure that the recipient has no reason to contest the invoice.

As e-invoicing is subject to constant change due to changing legal requirements, using a fully managed provider also provides peace of mind that your system will always be up to date. If new requirements are imposed by the legislator, these are implemented by the service provider and the company can make full use of the modified solution. There is no additional implementation effort for the company.

In short, fully managed EDI offers companies the possibility to use all EDI functions in their company without an expiration date – all while relieving internal teams.

Evaluating your options for document exchange with SAP

SAP document compliance undoubtedly offers a good basis for converting e-invoices into popular formats. Sending too can be effectively handled via SAP document compliance in combination with other SAP add-ons and extensive internal knowhow. However, handling EDI via a powerful single connection to a fully managed provider provides an easy-to-implement, future-proof and cost effective alternative for businesses without in-house expertise or simply looking to streamline the process.

To help you understand which option makes the most sense for you, we have identified 12 possible capabilities/funtionalities that you may desire from your SAP-EDI solution:

- EDI status visible on the SAP IDoc or SAP document (purchase order / invoice, etc.)

- Full text search across all documents

- Support for all standard EDI protocols

- Out-of-the-box routing to third party EDI networks (VANs)

- Out-of-the-box routing to Peppol

- Support for message conversion in EDI formats such as ANSI or EDIFACT

- Support for message split and merge

- Support for international e-invoicing requirements

- Automatic alerts when message failure occurs

- IDoc field conversions of ext./int. IDs in SAP

- EDI project coordination

- Ongoing support/monitoring/error resolution

For more information on these 12 points and to find out which solution offers what, download our white paper “EDI Integration in SAP: A Definitive Guide”. In it we expand on the specifics of these 12 functionalities and how they can benefit your business. We also compare the numerous options available to SAP users when it comes to EDI integration and how they differ in relation to these 12 factors.

Alternatively, if you have any other questions about EDI integration in SAP systems, or B2B data exchange more generally, please get in touch. We are always happy to help!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator. To try it out yourself!

SAP ERP and SAP S/4HANA are the trademarks or registered trademarks of SAP SE or its affiliates in Germany and in several other countries.