Making Tax Digital Explained

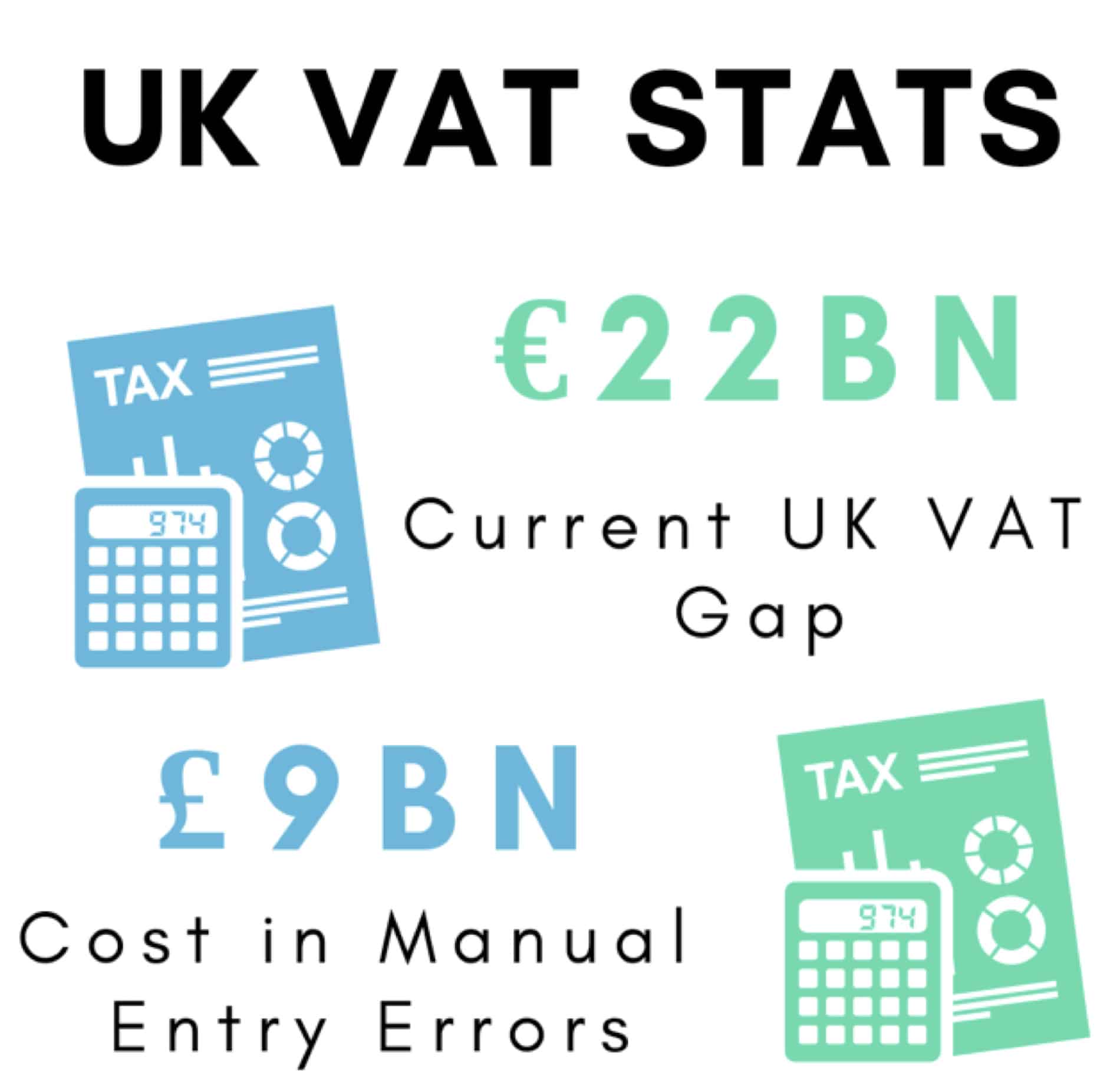

The VAT gap in the UK currently stands at €22 billion, and the UK government is seeking to reduce this figure, as are many other EU countries. Making Tax Digital, or MTD aims to not only do this, but also make the administration of tax easier on business owners. HMRC even states that manual entry tax errors cost the Exchequer a hefty £9 billion per year. The government believe that this is mainly due to avoidable errors, due to lack of knowledge, or inability to understand the process, and the government initiative may well help to reduce this figure.

They believe that the improvement in accuracy of data submitted, along with the software available with built-in assistance, as well as the data being sent electronically (leaving less chance of transposition errors) will contribute to lowering this cost significantly.

Who is affected

It is thought that around 1 million businesses will be affected by MTD. If you are a UK VAT registered payer, with a turnover of £85,000 and up annually, then you must be MTD compliant by April 1st 2019.

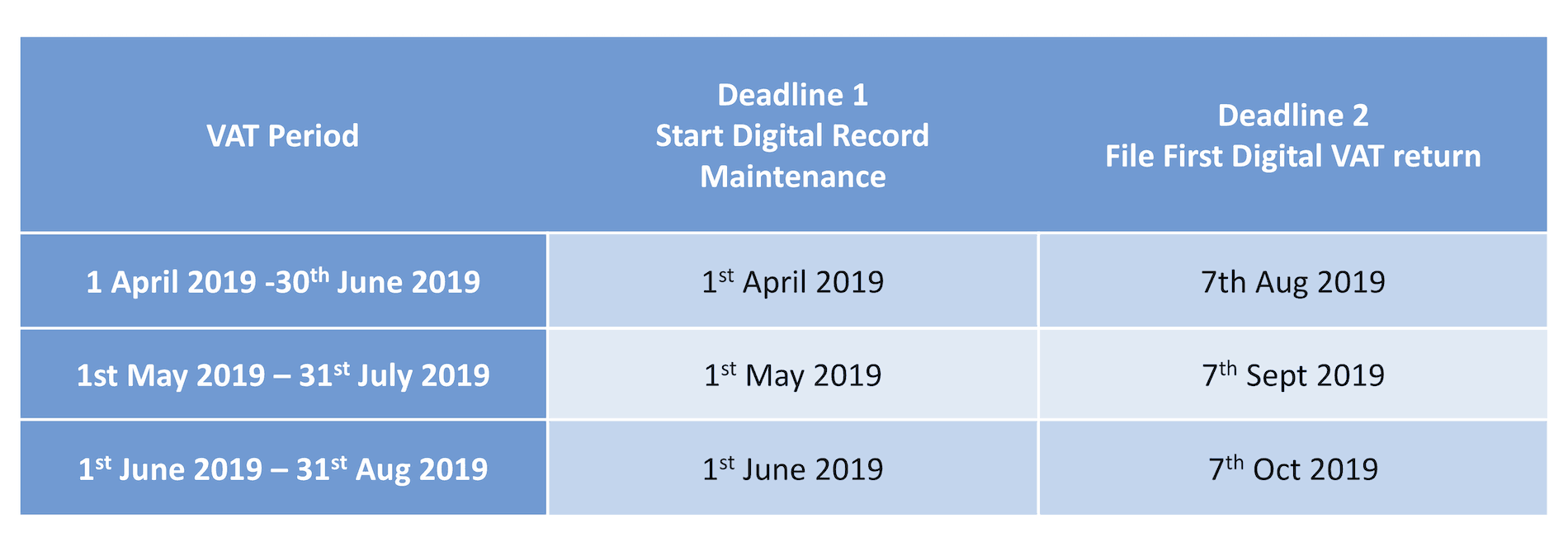

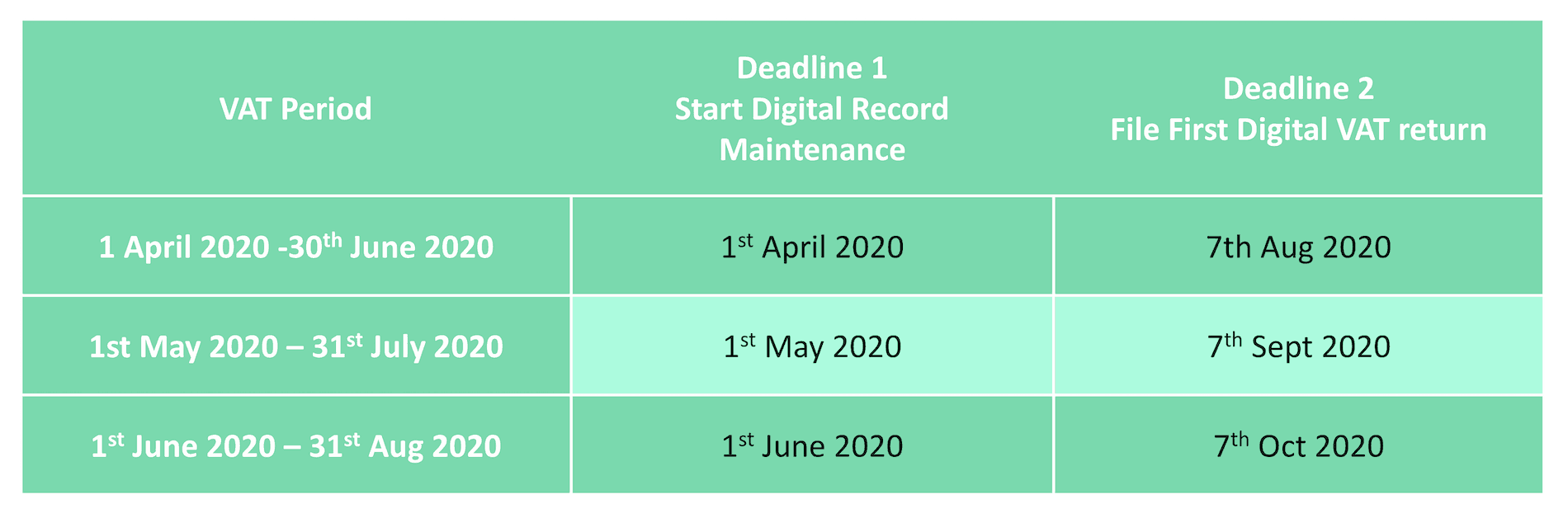

It is important to note, however, that the actual start date of MTD may well be different, depending on the VAT period of the business. To make this clearer, the relevant dates are illustrated below:

VAT Registered Businesses with their turnover of £85,000+

VAT Registered Businesses with their turnover of £85

It is also vital that complex entities such as ‘non-profits’, public corporations, and trusts etc., are aware that there is a deferral date of 1st Oct 2019.

VAT Registered Businesses with their turnover below £85,000

VAT Registered Businesses with their turnover below £85

How do businesses submit a digital tax return?

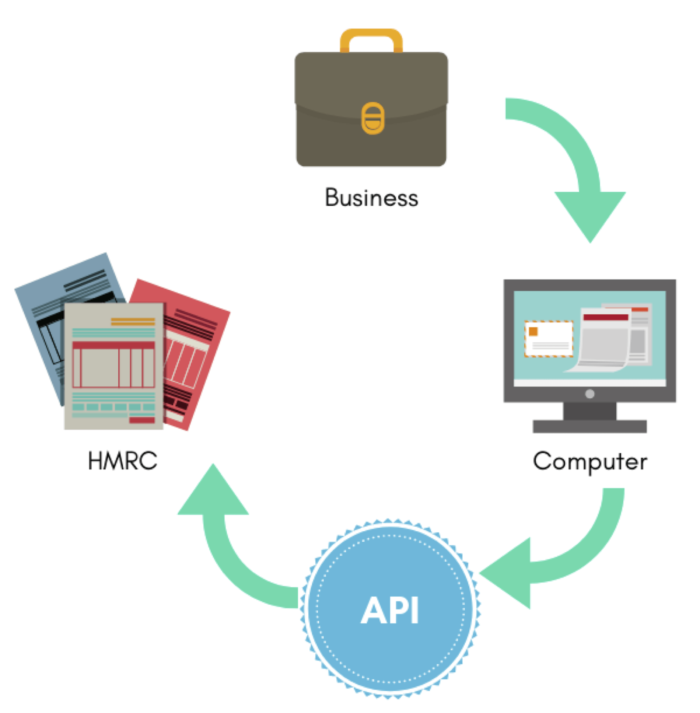

The 9 box VAT return style still stands, but businesses will be expected to transmit these online to customs using appropriate compatible software. HMRC’s Application Programming Interface (API) will be set up to receive these online submissions, but there needs to be a digital link to do so. What this means is that there is to be no manual data transfer between different programs or different parts of the same program. That essentially means that there will be no option for copy and paste or manual entry.

To help businesses, the government have given a grace period of a year for this digital link to be established – until 31st March 2020.

Failure to comply

There is, however, no grace period for compliance. From April 2019, businesses that fail to comply will be penalised, and the penalties are unlikely to be palatable to any business, no matter what the size.

Initially, the new ‘points based’ penalty system will apply, whereupon penalty points will accrue based on how many late filings are made and how late they were. Businesses that obtain more than 4 penalty points will be charged a penalty fee.

Somewhat akin to driving licences, points will be wiped from the record after a certain period – typically after 4 submissions that are compliant – and there will be an appeals process for those that feel the points decision is unfair.

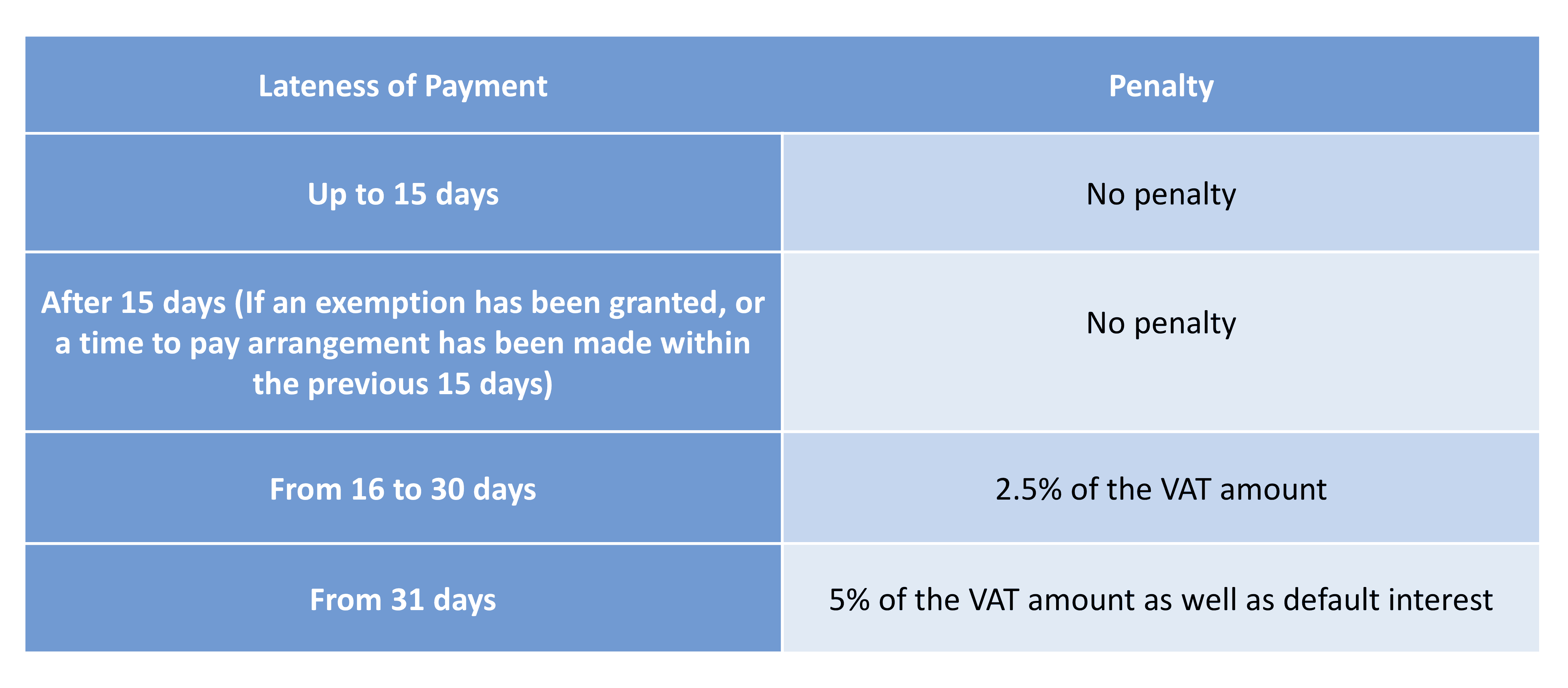

In terms of late payment penalties and interest charges, the following will apply:

Late payment penalties and interest charges

How to simplify your digital VAT return

Whether you’re a large business or a sole trader, if you’re still not sure how you’re going to go about submitting your digital VAT return, it is essential that you act quickly to ensure compliance and avoid penalties.

When choosing a supplier for your digital VAT return, although there’s not much time to waste, it is wise to seriously consider how your supplier will work with your existing setup, now and as your business grows. The right supplier can help your business achieve MTD compliance quickly and easily, and could also help act as a platform to enable other related messaging agitation, such as onboarding trading partners for B2B communications or governments for e-invoicing compliance.

Not only will this help ensure timely MTD compliance, but it will also reduce costs long term and can even help accelerate project delivery timescales.

In some cases, customers can save 40% or more from using automated services – so why not get in touch to find out how a strategic partnership with ecosio could take the pain out of your MTD VAT return and more?

Please contact us or check out our chat — we look forward to assisting you!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.