TL;DR summary

- Traditional two- and three-corner models offered basic electronic exchange but lacked scalability and interoperability

- The four-corner Peppol network architecture introduced open, standardised communication between independent access points

- The ViDA initiative is driving Peppol’s evolution toward real-time VAT reporting and continuous transaction controls

- The emerging five-corner model adds tax authorities as active participants in the Peppol network architecture

The way businesses exchange e-invoices has evolved considerably. From early, closed EDI systems to open, interoperable networks, and now towards real-time, compliance embedded models.

This blog outlines the journey from the now almost “legacy” two and three-corner setups, through the transformative, interoperable, four-corner model, to the additional five-corner model, aligned with the EU’s VAT in the Digital Age (ViDA) initiative.

Two- and three-corner models: traditional EDI

The earliest e-invoicing structures were rooted in traditional Electronic Data Interchange (EDI).

- The two-corner model represents a direct, point-to-point exchange between supplier and buyer.

- The three-corner model introduces a single intermediary or central platform to handle communication between trading partners.

While effective within closed business networks, these models are inherently limited in scalability and interoperability. Each connection tends to be bespoke, requiring specific technical agreements and preventing seamless cross-border exchange.

The four-corner model: Peppol’s decentralised network architecture

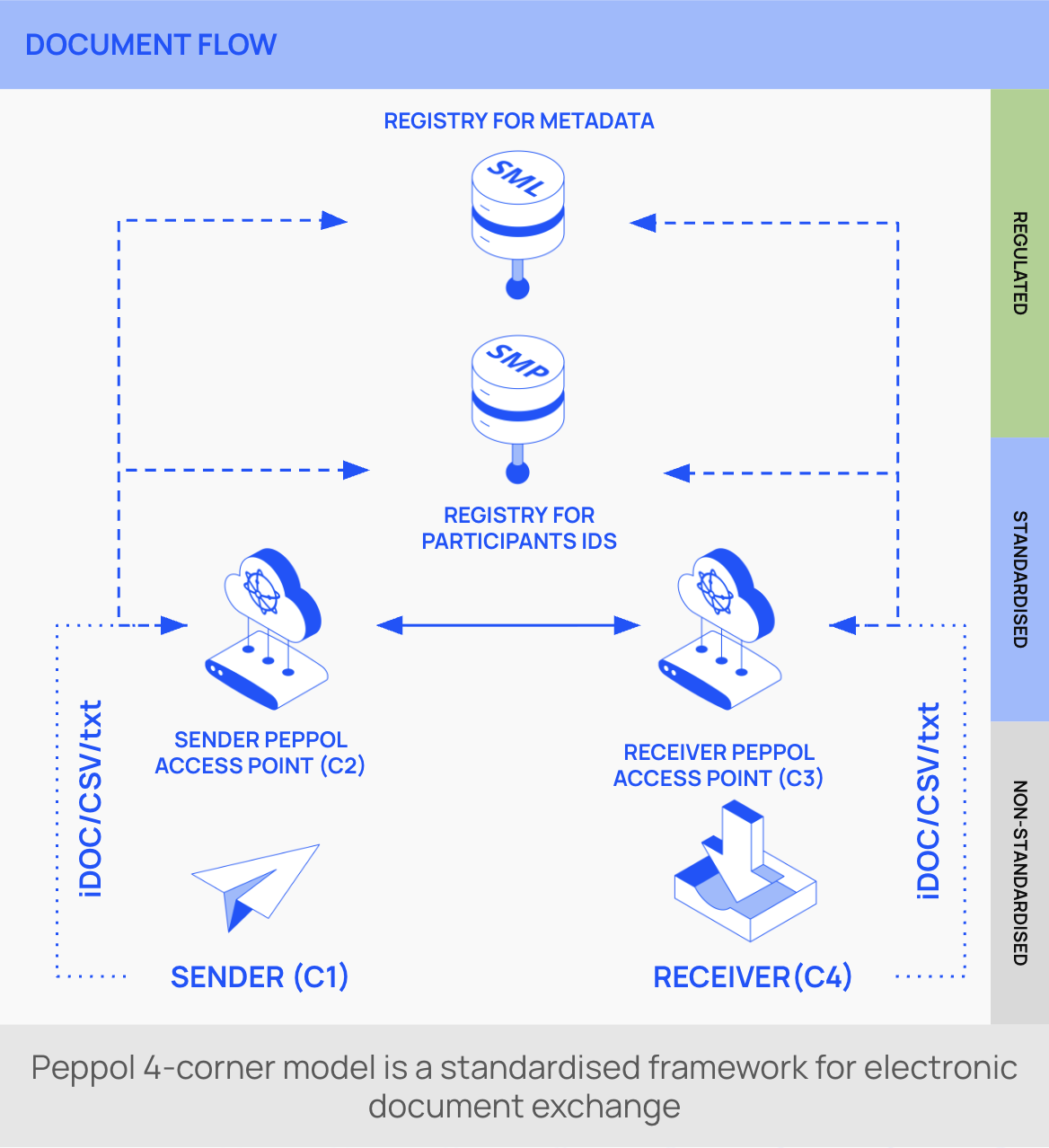

Peppol’s four-corner model marked a fundamental shift in how e-invoicing operates.

It introduced an open, decentralised network where suppliers and buyers connect via independent, certified access points that communicate using shared technical standards.

How it works:

- The supplier sends an invoice through their access point

- That access point identifies the buyer’s access point using Peppol’s service metadata locator (SML) and service metadata publisher (SMP)

- The invoice is securely transmitted through the Peppol network

- The buyer’s access point delivers the invoice to the buyer’s system

View our dedicated article for more information on what to look for when choosing a Peppol access point.

How Peppol’s four-corner model changed the game:

- It established true interoperability – “connect once, reach all”

- It reduced technical barriers by introducing a standardised approach across participants

- It enabled cross-border and cross sector e-invoicing within a trusted, standards-based environment

- EIt encouraged competition and innovation among service providers, all operating under the same framework

The four-corner model effectively turned e-invoicing into an open, networked ecosystem. It is now the foundation of e-invoicing across Europe and an ever-growing number of regions globally.

The ViDA pilot: towards real-time VAT reporting

Before exploring the five-corner model, it’s important to understand the context of the ViDA (VAT in the Digital Age) initiative, which was launched by the European Commission to modernise VAT reporting and administration across the EU.

What ViDA aims to achieve

ViDA’s goal is to create a harmonised approach to digital reporting and e-invoicing across member states. One of its key elements is the introduction of digital reporting requirements (DRR), which involve near-real-time submission of transactional data to tax authorities to support VAT compliance.

The Peppol ViDA pilot

To support this vision, OpenPeppol launched the Peppol ViDA pilot, working alongside European tax authorities, solution providers, and businesses. The pilot demonstrates how the existing Peppol network architecture and wider infrastructure can facilitate ViDA’s digital reporting goals.

According to Peppol’s official documentation, the pilot…

- Tests how Peppol’s network architecture and standards (such as EN 16931) can be extended to handle real-time VAT reporting

- Covers both cross-border and domestic transactions

- Seeks to ensure interoperability not only between businesses, but also between businesses and tax administrations

Why it matters

The pilot confirms that Peppol’s four-corner model can evolve to meet regulatory requirements without losing its core interoperability principles. Rather than replacing the existing Peppol network architecture, ViDA builds upon it, introducing continuous transaction controls and preparing the ground for the five-corner model.

What is Peppol’s five-corner model?

The five-corner model represents the next stage of Peppol’s evolution. It extends the four-corner architecture by adding a fifth actor (or “corner”): the tax authority or government compliance node.

Actors:

- Supplier

- Supplier’s access point

- Buyer’s access point

- Buyer

- Tax authority

How it works:

- The supplier sends an invoice to their certified Peppol service provider (access point)

- The invoice is checked, mapped, validated, and prepared for delivery

- Before or immediately after the delivery to the buyer’s access point, a copy of the invoice data is sent to the tax authority

- The tax authority receives the data for monitoring, control, or audit purposes

- The invoice is delivered to the buyer through their own Peppol access point

Why it matters:

- It introduces real-time compliance and regulatory visibility directly into the e-invoicing flow.

- It supports the CTC model being developed under ViDA, enabling tax authorities to receive invoice data almost instantly.

- It builds on the existing Peppol infrastructure rather than creating separate national systems.

- It allows businesses to continue using standard Peppol connections while meeting new reporting obligations.

This five-corner design shows how Peppol is aligning itself with Europe’s digital VAT transformation and therefore bridging interoperability and compliance within a single framework.

The different corner models compared

| Model | Structure type | Main actors | Interoperability | Compliance integration | Typical use case |

| Two-corner | Traditional EDI | – Supplier

– Buyer |

None (direct link only) | None | Point-to-point B2B connections |

| Three-corner | Traditional EDI | – Supplier

– Intermediary – Buyer |

Limited (depends on central platform) | None | Closed domestic or sector networks |

| Four-corner | Peppol Network | – Supplier

– Supplier AP – Buyer AP – Buyer |

High – open, standardised | Medium | Cross-border e-invoicing (traditionally) |

| Five-corner | Peppol + ViDA / CTC | – Supplier

– Supplier AP – Buyer AP – Buyer – Tax authority |

High (same as four-corner) | High (real-time reporting) | Digital VAT reporting under ViDA |

Want to get Peppol connected?

At ecosio we are experts in Peppol and e-invoicing and were one of the very first Peppol access points in Europe. To date we’ve helped hundreds of companies to integrate efficient e-invoicing processes into existing systems and experience the benefits of Peppol.

As a certified Peppol access point provider, ecosio enables seamless global e-document exchange through one secure connection. Our managed service covers everything from set-up to daily operation, helping your business to save time and resources.

Want to know more? Speak to an expert today!