Australia uses the Peppol network for e‑invoicing, led by the Australian Taxation Office (ATO). Since 1 July 2022, federal agencies must be able to receive Peppol e‑invoices, while B2B use is voluntary under the Business E-invoicing Right (BER). This guide explains what’s required, how Peppol works in Australia, and how to get connected.

- Australia mandates federal agencies to receive Peppol e-invoices for B2G transactions, while B2B adoption remains voluntary but strongly encouraged.

- The country uses the globally recognised Peppol BIS Billing 3.0 standard with the PINT A-NZ profile, ensuring cross-border interoperability.

- Businesses need to connect through ATO-accredited Peppol Access Points using a valid Peppol Participant ID to send and receive compliant e-invoices.

- Australian tax law requires companies to retain e-invoice records and supporting documentation for a minimum of five years.

- The shift to PINT A-NZ has improved tax handling, validation rules and alignment with international Peppol markets, positioning Australia as a forward-thinking adopter of digital invoicing.

Australia’s forward-thinking approach to e-invoicing

While Australia is far from the first country to adopt e‑invoicing, it has taken a particularly collaborative and future‑oriented approach. The government sees Peppol as a way to:

- Modernise procurement

- Reduce manual handling and fraud

- Speed up payment cycles

- Improve business productivity

- Support cross‑border trade with Peppol‑enabled countries

For businesses, the appeal is straightforward: no more emailed PDFs, OCR errors, manual keying or ambiguous invoice formats. Instead, Peppol delivers a secure, structured, machine‑readable invoice that can be validated, transmitted and processed automatically, end to end.

Australia also benefits from being part of a rapidly expanding network. Countries such as Singapore, Japan, Germany, France, and New Zealand are adopting or requiring Peppol‑based e‑invoicing, making it easier for Australian companies to trade internationally.

Australia’s journey so far

Australia’s road to Peppol began with a broader push for digital transformation in government and business. The turning point came in December 2019, when the ATO formally adopted Peppol as the national e‑invoicing framework.

The ATO’s role as Peppol Authority

The ATO is responsible for:

- Accrediting Peppol access points

- Maintaining local Peppol policies

- Ensuring interoperability through national rules

- Educating government and industry

- Coordinating with New Zealand on joint standards (like PINT A‑NZ)

In practice, this means the ATO ensures that Australia’s adoption stays aligned with global Peppol standards while still meeting local tax and procurement requirements.

B2G e-invoicing in Australia: steady federal and state adoption

Federal agencies were mandated to be able to receive Peppol e‑invoices from 1 July 2022. Implementation has continued across state and local entities, with the list of e‑invoicing‑enabled organisations growing.

B2B e-invoicing in Australia: encouraged, but not mandated (yet)

Although the Treasury explored the Business E‑invoicing Right (BER), the current government has not introduced a mandate. Instead, the ATO promotes voluntary adoption. Many businesses still gain automation benefits and future‑proof for potential policy changes.

Key Australia e-invoicing milestones

| December 2019 | Australia adopts Peppol as the national e‑invoicing framework |

|---|---|

| 1 July 2022 | B2G reception capability required for federal agencies |

| 15 November 2024 | PINT A‑NZ becomes mandatory profile for AU/NZ |

| 15 May 2025 | Prior A‑NZ profile no longer supported |

How Peppol works in Australia (the four‑corner model)

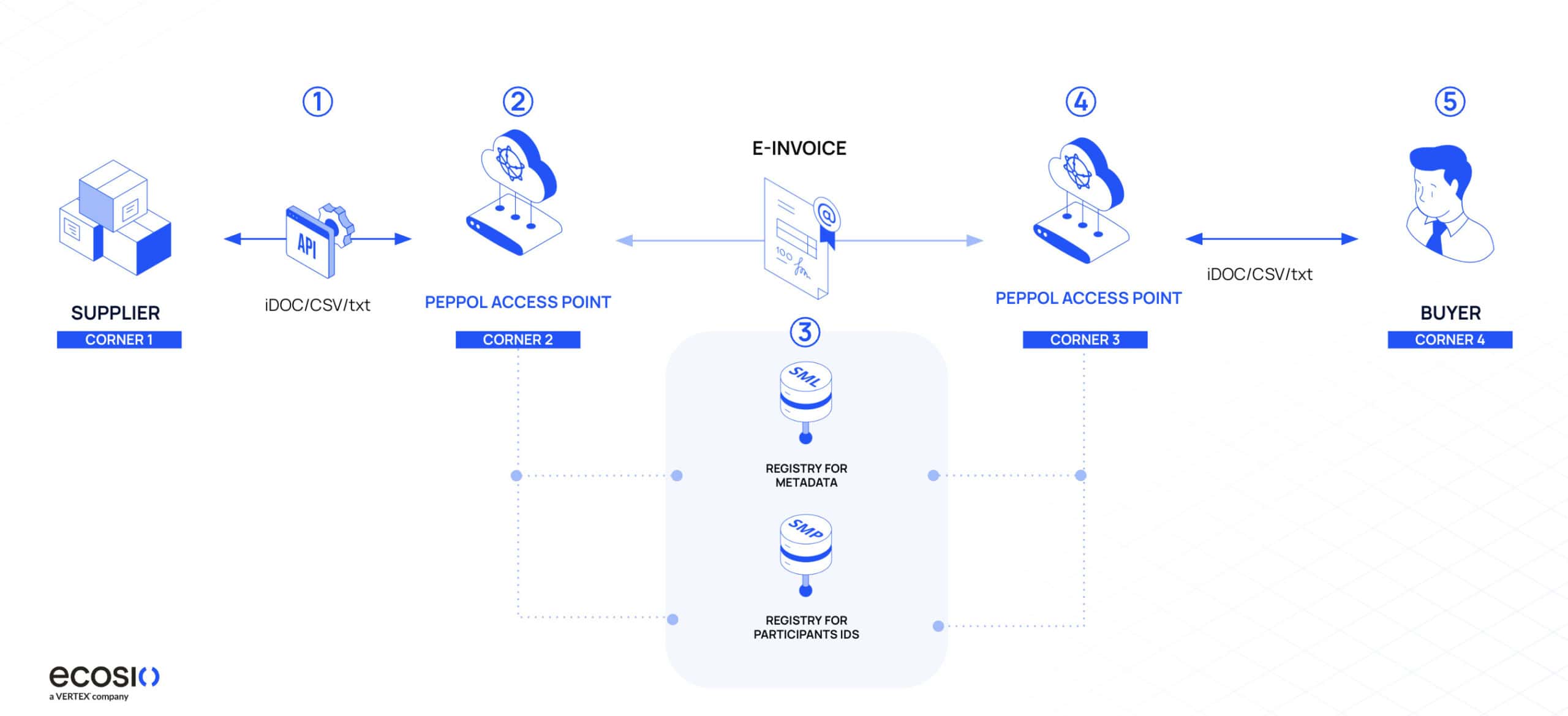

Australia follows the global Peppol four‑corner model, which ensures interoperability and decentralisation:

- The supplier (Corner 1) creates an invoice in their ERP

- The supplier’s access point (Corner 2) validates, packages and sends the invoice using AS4

- The buyer’s access point (Corner 3) receives and forwards it

- The buyer (Corner 4) posts the invoice into their AP or ERP system

Message level responses (MLRs) provide structured notifications (accepted, rejected, delivered or failed) ensuring full traceability.

Technical snapshot

- Profile: PINT A‑NZ on Peppol BIS Billing 3.0

- Documents supported: Invoices and credit notes

- Transport: AS4 via the Peppol network

- Identifiers: Peppol Participant ID required for both sender and receiver

- Digital signatures: Not required under AU e‑invoicing rules

- Attachments: Allowed as supporting files, but do not replace structured data

What changed with PINT A‑NZ?

PINT A‑NZ marks a significant step for harmonisation between Australia, New Zealand and the wider Peppol ecosystem. As e‑invoicing adoption grows globally, ensuring consistent technical standards across regions is essential for businesses trading internationally. PINT A‑NZ addresses previous limitations in tax handling, validation and interoperability, making cross‑border invoicing more reliable and reducing the friction caused by regional format differences.

For Australian businesses, key improvements include:

- Better handling of complex tax scenarios

- Cleaner alignment with BIS Billing 3.0

- Stricter validation and clearer rules

- Improved cross‑border interoperability

- Alignment with new Peppol markets (e.g. Singapore, Malaysia, Japan)

From 15 November 2024, only PINT A‑NZ is accepted by AU/NZ access points.

From 15 May 2025, older profiles are not supported at all.

Practical steps to get started

Whether you’re a public agency or a business supplier, the onboarding path is similar, and involves five key steps:

- Choose an ATO‑accredited Peppol access point partner

- Register your Peppol participant ID and confirm your identifiers for trading partners

- Validate BIS Billing 3.0 messages in PINT A‑NZ end-to-end, including taxes, allowances or charges, and references

- Test Message level responses, error handling and retries

- Put policies in place for five‑year record retention and audit trails

Frequently asked questions

Is e‑invoicing mandatory in Australia?

B2G reception is mandatory for federal agencies. B2B remains voluntary, supported by the BER initiative.

Do I need a digital signature?

No. Digital signatures are not required for Peppol e‑invoicing in Australia.

Is a Peppol Participant ID required?

Yes. Both sender and receiver need a valid Peppol ID for secure routing on the network.

Is self‑billing supported?

Yes, via the PINT A‑NZ self‑billing specification, provided trading partners agree.

Can I include attachments?

Yes. Supporting files such as PDFs or timesheets can be attached, but they never replace the structured XML.

How ecosio helps

ecosio delivers native Peppol connectivity with full visibility and operations:

- Conformance with Australia’s Peppol requirements and PINT A‑NZ profile

- Schematron‑based validation and proactive error handling

- Real‑time monitoring, Message Level Responses and audit trails

- ERP‑agnostic integration and expert onboarding support

Ready to dive deeper?

Explore Australia’s e-invoicing requirements in detail on our dedicated country page, or talk to our team to plan your rollout.

Feel free to also check our other blogs and resources to better understand the Peppol system: