The Purchase-to-Pay process

A Purchase-to-Pay process is defined as the process from the dispatch of an order up to settlement of the supplier accounts payable. The Purchase-to-Pay process should thus be assigned to the procurement side of a company. The Purchase-to-Pay process may in some cases also be called Procure-to-Pay process. The Order-to-Cash process is the sales side equivalent of the Purchase-to-Pay process.

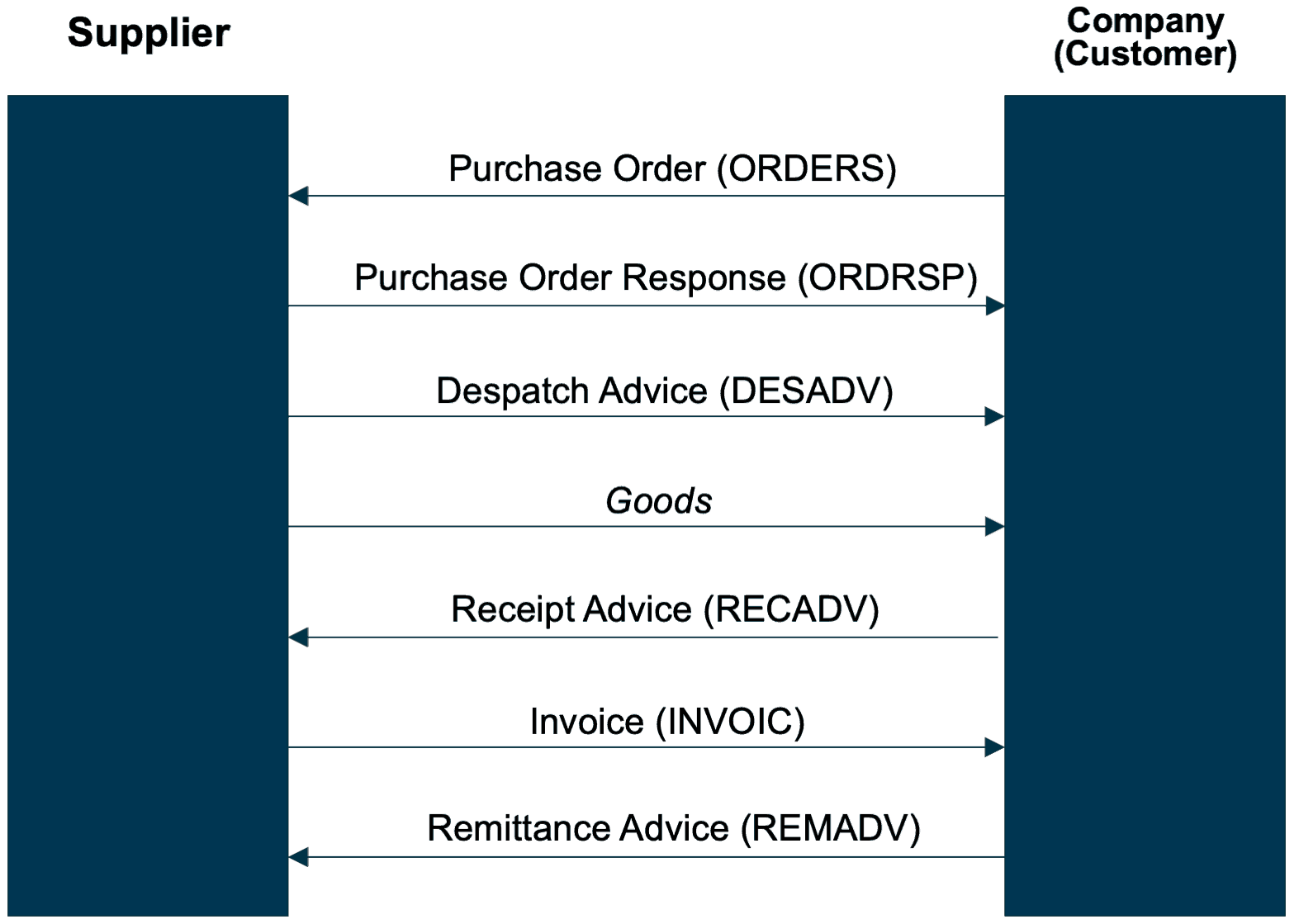

The diagram below shows an example of a Purchase-to-Pay process between a company (the customer) and a supplier.

Example of a Purchase-to-Pay process

Today, Purchase-to-Pay processes are executed with the support of EDI messages. Instead of paper documents, electronic business documents are exchanged directly between the IT systems of involved partners, with minimal human intervention.

The diagram above shows a customer transmitting an electronic purchase order (ORDERS) to a supplier. A supplier will be able to directly read the order data into his ERP system to also check the order there.

A positive or negative purchase order response (ORDRSP) will be returned, depending on acceptance of the order or not. A supplier may indicate in his order response whether he accepts the order as is, accepts with changes or declines. A customer may in some instances also change his original purchase order. To do this, a customer will transmit a purchase order change (ORDCHG) to his supplier. For the sake of clarity, order changes are not shown in the diagram above. Order changes are also acknowledged with an order confirmation (ORDRSP).

Suppliers will send a despatch advice (DESADV) to their customer before shipping the goods. The despatch advice will inform the customer of an imminent delivery, allowing him to prepare his inbound logistics – e.g. free up storage space.

Upon receiving the goods, the customer will transmit a goods receipt advice (RECADV) to the supplier. With the goods receipt advice, the supplier is informed about any deviations, possibly due to loss in transit or rejection of goods.

A supplier will invoice his customer after delivery. A customer will provide the supplier with a remittance advice (REMADV) after settlement of the invoice.

Different types of documents may be used depending on the application and degree of complexity of the process.

Purchase-to-Pay process in an SAP ERP system

ERP system support is required for the effective implementation of a Purchase-to-Pay process. ERP systems such as SAP ERP offer excellent support for various types of Purchase-to-Pay processes and the necessary EDI document types.

In an SAP ERP system the Purchase-to-Pay process is supported by the MM module (Materials Management). Invoices may also have dependencies to the FI module (Finance) – especially invoices without an order reference.

Any questions?

Any questions about Purchase-to-Pay processes and support by EDI – also in connection with SAP systems? Please contact us – we look forward to assisting you!

SAP ERP and SAP S/4HANA are the trademarks or registered trademarks of SAP SE or its affiliates in Germany and in several other countries.