Why XRechnung?

Since last November, federal authorities in Germany have been required to receive and process the XRechnung. From November 27th 2020, all public administration contractors are required to create and send invoices in this format.

The XRechnung is the German CIUS (Core Invoice Usage Specification), which was developed in accordance with European Standard 16931 , and originated from EU Directive 2014/55 / EU. EN 16931 provides two valid XML schemas: Universal Business Language (UBL) and UN / CEFACT Cross Industry Invoice (CII). This means that invoices must be submitted in one of the two formats.

By creating the XRechnung, a standard was created that defines the common structure of an electronic invoice and allows contractors to automate invoice workflows using common technologies.

Although the use of the standard is initially only mandatory for the B2G sector (business-to-government), it is foreseen that, due to the legal requirements in this area, the standard will rapidly spread in Germany and will also find its way into other sectors – in the B2B area (Business to Business) e.g. Thus, it makes sense to fully integrate the standard. This means companies should be able to create and send an XRechnung, and also receive and process them.

The most important steps for a successful implementation of the XRechnung

In the following sections, we will discuss the key points that a company needs to review and plan before starting the actual implementation and introduction of the XRechnung.

The Necessary Steps to Successfully Implement the XRechnung Standard in the Company

Check your own ERP system

Which requirements does the ERP system already meet, which functions can be extended in the system, and for which areas should external support be requested? In order to answer these questions, a company must first decide whether XRechnung are only sent or also received. The necessary steps for both scenarios are as follows.

Create and send invoices

First, the invoicing process needs to be considered: How are invoices being created right now? If the company still works with paper invoices, a solution must be found to digitize the process. If an ERP system is already in use, it must be checked whether it can generate electronic invoices in the current state, or whether a software module must be additionally activated. If necessary, an extension must also be programmed in the ERP system.

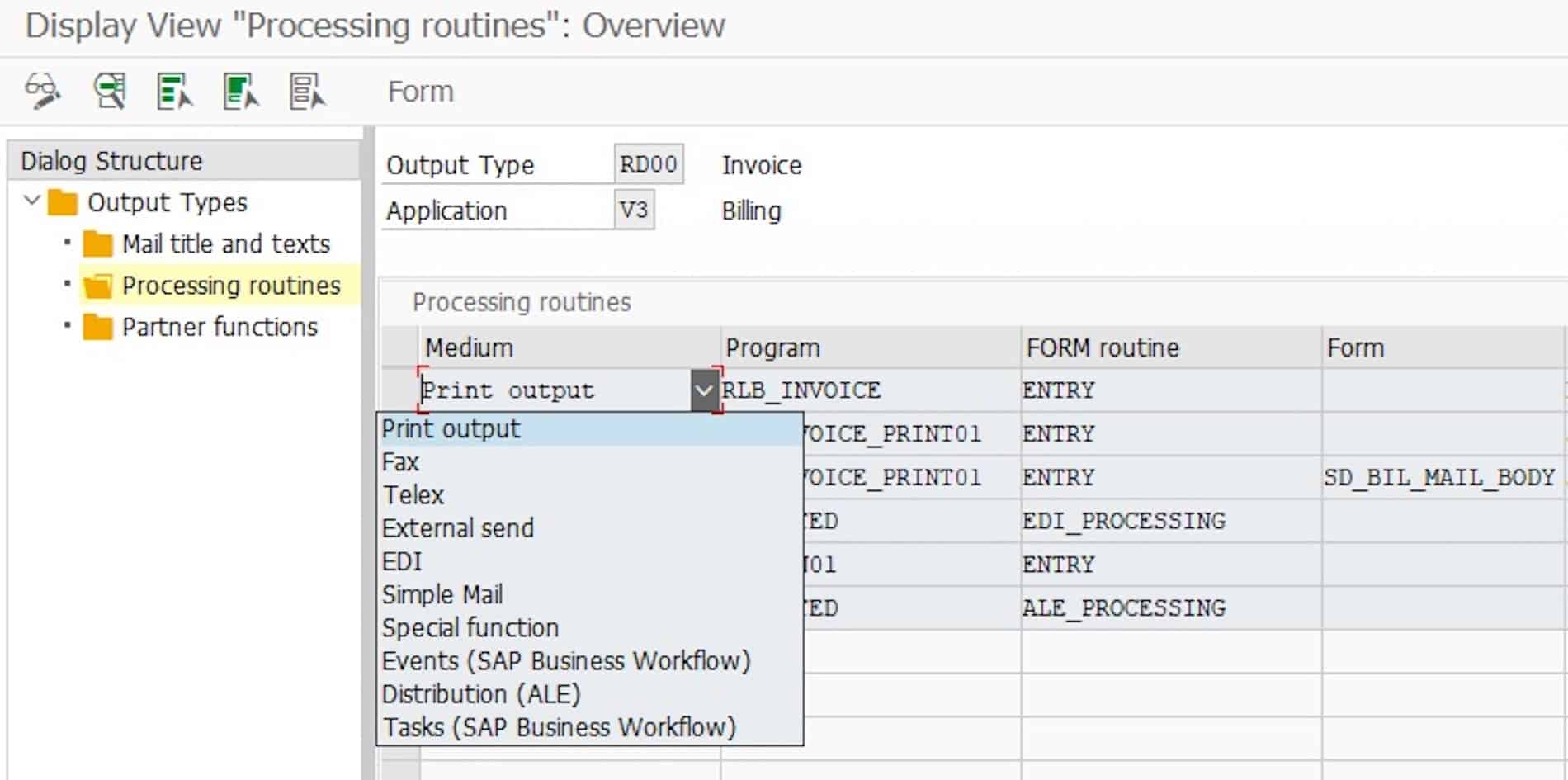

ERP settings

Changing the invoicing process also requires adjusting the general message settings in the ERP system. In the case of SAP ERP, this means, for example, that the message search must be adapted, and the shipping of printed output must be changed to EDI. A corresponding project should be set up for this purpose, as it is necessary to implement the settings, to test them, to train the department, to implement the EDI connections, to coordinate external service providers, etc.

SAP Customizing Settings for Message Search.

In addition to the necessary settings in the ERP system, the creation of the required target format, XRechnung, must also be checked.

Create an XRechnung

ERP systems, such as SAP ERP, cannot natively create documents in UBL or UN / CEFACT CII formats. In order to be able to convert documents into the required format, it must be clarified whether the ERP system has a suitable export interface. Using this interface, the necessary data can be made available to a converter. The converter receives the exported data and creates the e-Invoice which corresponds to the standard XRechnung.

If a converter for other document types is already in use, it can possibly be extended. If no converter is used yet, the company must search for a suitable solution. There are several possibilities: Either the manufacturer of the ERP system offers a module or the internal IT department develops the necessary conversion. In order to save resources, it is also possible to commission a service provider who converts the internal data format into the XRechnung format. In this case, the service provider normally also handles the delivery of the message to the invoice recipient and the monitoring of the invoice data exchange.

Ideally, exporting and converting data is an automated process that does not require human input. However, to be able to ensure that the process is error-free, all necessary master data must first be maintained in the system. It is important that, for example, article names and identification numbers, units of measure, partner identifications, etc. are maintained consistently. Also the receiver IDs (in the XRechnung also Leitweg-ID) of the invoice recipients must be present, otherwise documents cannot be delivered with automatic transmission methods. This also brings us to the next point: Now that a company has determined how and whether an XRechnung can be created, it is necessary to check which transmission method should be used.

Transferring XRechnung

The following technologies can be used when companies only generate a few invoices and send them to authorities:

- De-mail

- EGVP (Elektronisches Gerichts- und Verwaltungspostfach/Electronic Judicial and Administrative Mailbox) / VPS (Virtuelle Poststelle des Bundes/Virtual Post Office of the Federal Government).

To be able to send invoices in bulk, the methods mentioned above are out of the question and special transmission protocols must be used. The authorities in Germany rely on Peppol (Pan-European Public Procurement Online) – a widely used protocol that has been developed by the EU. In order to be able to send documents via Peppol, an access point is required. If the ID of the recipient is known, documents can be sent to any recipient in the Peppol network via this one access point. Here, the great advantage of this delivery method becomes recognizable – The recipient identifier is enough (in the case of XRechnung the Leitweg-ID) to send invoices to any public invoice recipient in Germany.

Therefore, as a company you do not have to build many different connections to the authorities, but one single connection to a Peppol access point is enough. For this purpose, companies can outsource a service provider who provides a certified Peppol access point via which data can be exchanged with the recipient.

Peppol works bidirectionally – i.e. Peppol also enables a company to receive structured data from authorities. Possible future applications would be, for example, order data.

Peppol is not limited to communication with the authorities but is also widely used in the B2B sector. Once you have a connection to a Peppol access point, every participant in the Peppol network can be reached all over the world – regardless of whether they’re an authority or a company. Therefore, all invoice recipients who support Peppol can receive files with a single connection. In addition, as mentioned earlier, all authorities in Germany can receive documents via Peppol.

In summary, the following tasks for a company result in the sending of invoices:

- Check the invoicing process in the ERP system

- Check options for exporting the data

- Realise translation of the ERP-internal data to XRechnung

- Check ways to send invoices

- Check processing of the invoice dispatch in daily operation

Receive and Process XRechnung

Before companies deal with the import of XRechnung, they should first analyse the current workflow for receiving and approving incoming invoices in the company. What does this look like and can the receiving and processing of XRechnung be integrated into them? The processing of high invoicing quantities may already take place automatically in the ERP system, thereby saving resources and reducing the error rate. The goal should be to convert XRechnung into a format that can be processed by the system in order to ensure seamless integration into existing processes.

Furthermore, a channel is needed over which companies can receive documents. Again, contact with business partners should be established to agree on a transmission protocol. This protocol can be, for example, Peppol, for which a Peppol access point is required, as in the case of invoicing. As explained in the previous section, a service provider can provide it and thus act as a forwarder.

In order to be able to import the received documents into the ERP system, an import interface is required via which the data can be read into the system and thus made processable. If such an interface already exists, it must be checked whether it can also work with UBL and UN / CEFACT CII. If not, the IT department or an external specialist must be assigned to implement and integrate a solution. It is also important to pay attention to the maintenance and structuring of the master data: Can external article units be recoded, or does the process have to be implemented in ERP? How the sender ID can be assigned to the vendor should also be clarified.

As part of the receiving of the invoice, the following tasks arise for the company:

- Check the invoice receipt process and the ERP system used

- Check possibilities for receiving XRechnung

- Check options for importing the data

- Check the processing of the invoice receipt in daily operation

Ongoing transmission and monitoring

The processes for sending and receiving XRechnung are ideally fully automated. Normally however, there is always the possibility that errors occur during the conversion or transmission of the invoices because, for example, mandatory data is not available for the creation of the XRechnung. The entire inbound and outbound invoice process must therefore be constantly monitored so that errors can be dealt with in a timely manner. If a company has developed its own solution for handling XRechnnung, surveillance measures must be taken to allow those responsible to stop the process and troubleshoot it.

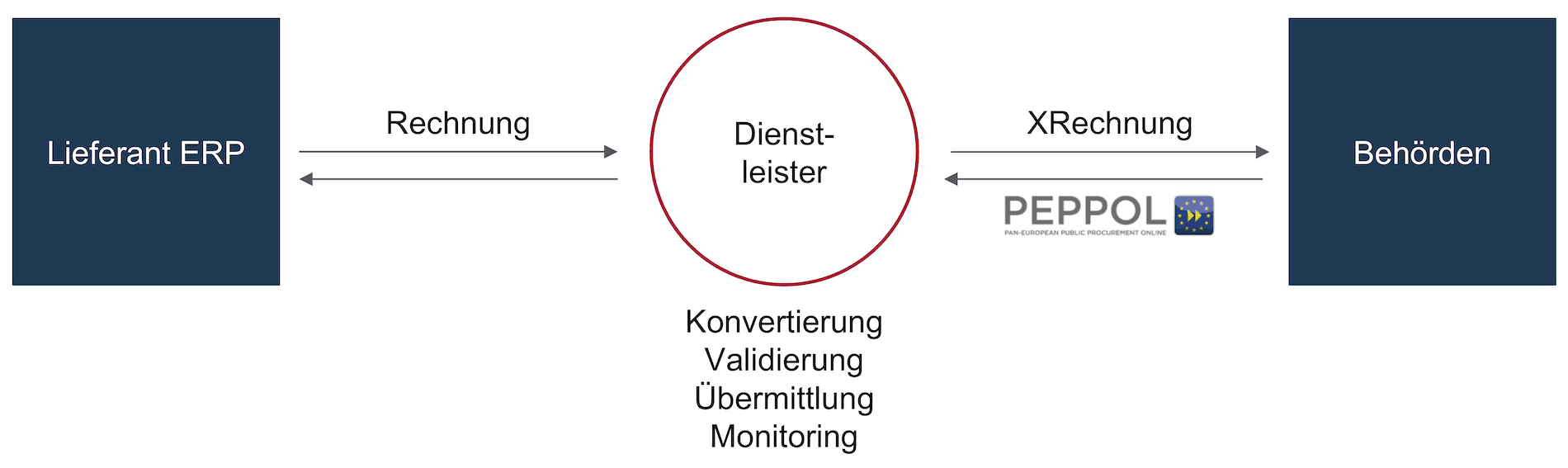

When an external invoicing process specialist has been called in, it already has the necessary systems and processes in place to ensure end to end monitoring. To save resources and avoid a solution in the company’s ERP system, which, with its different modules and software components, is difficult to maintain, the service provider can also take care of the conversion and validation of the documents.

Example of an XRechnung Workflow Using a Service Provider

As a result, internal processes remain virtually untouched, as the service provider takes over the creation and validation of the XRechnung. If the creation or validation of an XRechnung fails, it will not be transmitted to the recipient. Instead, a troubleshooting process starts. If the error is, for example, missing data, the responsible persons in the company are notified. This process runs automatically and can also be combined with existing workflows in the ERP system – e.g. with SAP Workflows.

Thus, only valid invoices will be sent and there will be no reason for the recipient to contest them.

Summary

To implement the XRechnung, the actual status of the affected processes and the ERP system must first be checked. It should also not be forgotten that the processes used must be monitored in order to eliminate errors in good time. In doing so, companies can expand their existing systems or commission a service provider who handles the conversion, transfer and monitoring of the processes.

Any questions?

Do you have any questions about XRechnung? Please contact us or check out our chat – we are happy to help!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator. Try our free Peppol tool out yourself.