On 28 July 2023 the French Finance Ministry released a statement confirming that the introduction of mandatory e-invoice clearing in France will be postponed from the previously agreed date of 1 July 2024. This date was initially set on 15 September 2021 following a report published in October 2020 and the establishment of a special service with “Mission Facturation Électronique” (MFE).

On 15 September the French Tax Authority discussed the following possible timeline, to be confirmed in the 2024 budget:

- 2024 – Completion of the PPF (national invoicing portal)

- 2025 – Pilot period

- March 2026 – Phase one: large companies

- October 2026 – Phase two: medium companies

- 2027 – Phase three: small companies

For a general overview of e-invoicing in France in relation to B2G and B2B, you may also be interested in our other article “B2G and B2B E-invoicing in France”.

B2B invoicing in France – the situation at a glance

For several years now, all French companies supplying a public entity (i.e. B2G) have been required to send structured electronic invoices via the national invoicing portal Chorus Pro (read more information in our other article “B2G and B2B E-invoicing in France”).

In recent years the French government has also been very clear about its desire to extend mandatory e-invoicing in France to B2B transactions too. In order to accelerate this, a timeline of e-invoicing compliance deadlines was published in September of 2021. The earliest of the proposed deadlines was 1 July 2024, by which time all French companies would have been required to be able receive electronic invoices, and large French companies to be able to send them. However, the French Finance Ministry subsequently confirmed that this deadline was being postponed.

Despite the postponement, France still intends to introduce continuous transactions controls (CTC) and make e-invoicing in France mandatory for B2B transactions. L’Agence pour l’Informatique Financière de l’Etat (AIFE) was recently established as the national e-invoicing authority for this purpose, and the government has also repeated its desire to move forward with the project despite the change in timescale.

Explaining the decision to postpone the compliance deadline, the 28 July press release noted that the decision was made “in order to provide the necessary time for the successful implementation of this impactful reform for the economy”.

What are the new compliance deadlines?

The new deadlines regarding B2B e-invoicing in France should be confirmed in the 2024 budget. According to an update from the French Tax Authority on 15 September 2023, the timeline is expected to be:

- 2024 – Completion of the PPF (national invoicing portal)

- 2025 – Pilot period

- March 2026 – Phase one: large companies

- October 2026 – Phase two: medium companies

- 2027 – Phase three: small companies

How e-invoicing in France works

What standards are used and how does delivery work?

The following principles have already been established:

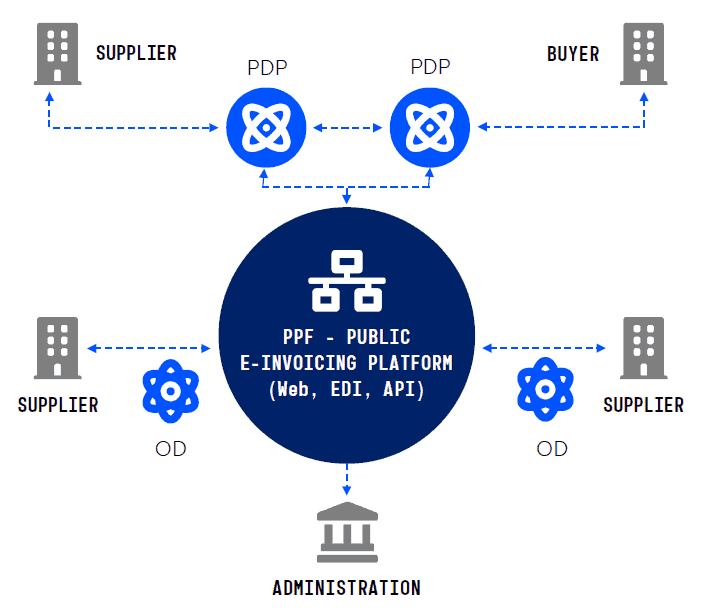

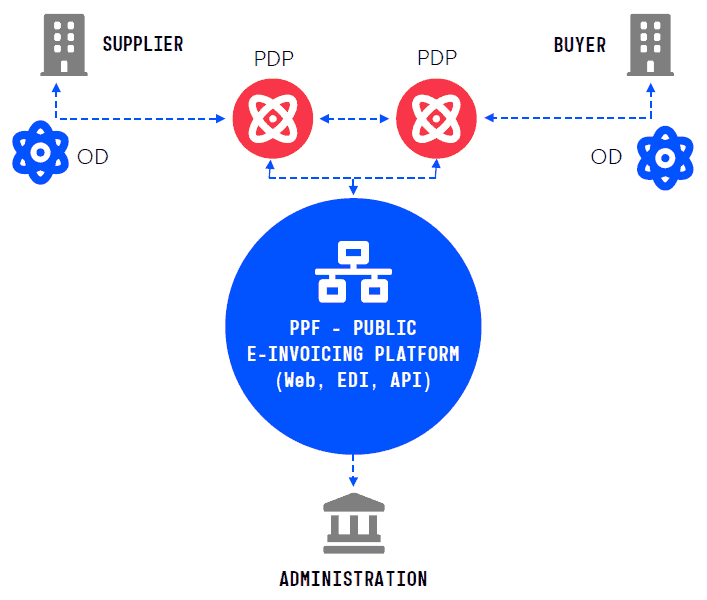

- Message delivery takes place via the “Y approach” (explained below)

- France provides a registration system for platforms to ensure secure exchanges

- France offers a public platform that provides a minimum set of services for the exchange of e-invoices and acts as a hub for e-invoicing and electronic transmission of data to the administration

- Alternatively, companies may decide to enlist the help of a service provider (such as ecosio) to manage the e-invoicing for them

- EN 16931 CIUS is required as the technical format

The choice of the “Y approach” is very interesting, as it leaves some options open and offers important advantages for companies in France with regard to B2B e-invoicing:

The “Y approach”

The “Y approach” was created for B2B invoicing in France in order to cover the following scenarios:

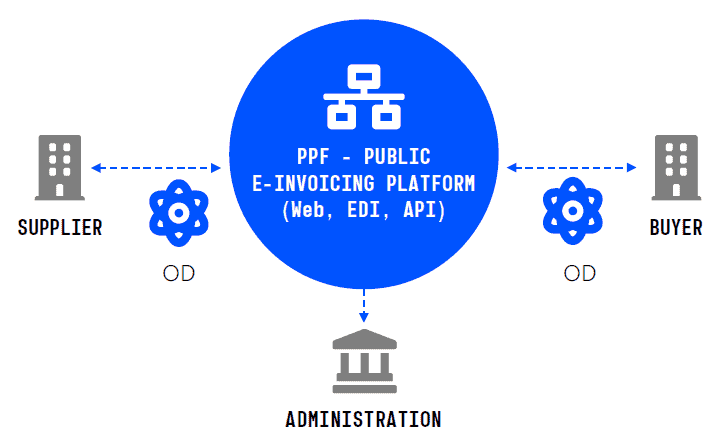

- Both supplier and buyer use the public platform

- One of the parties uses a private certified platform which handles the transfer to the public platform, while the other party uses the public platform directly.

- Both parties use private platforms

According to the Y approach, invoices can therefore also be exchanged via private platforms, which are responsible for extracting and transmitting the data to the public platform. The public platform then transmits the data to the tax authorities.

This offers the following advantages:

- Free choice of e-invoice service provider

- Continuation of established structures for certain sectors (e.g. the automotive industry and retail can continue to use their existing systems)

- Autonomy in case of failure

- Flexibility depending on the type of business

- Complementary services of private platforms can be used

A detailed look at the components of the “Y” approach

PPF – Portail Public de Facturation (Public Invoicing Portal)

The public invoicing portal known as the PPF (Portail Public de Facturation) is a central invoice exchange portal/hub. It allows for the routing of invoice messages from sender to receiver and relays invoice information to the administration. It also contains a directory of all French companies.

Supported protocols

- PeSIT HS E

- SFTP

- AS/2

- AS/4

- API

PDP – Plateforme de Dématérialisation Partenaire (Electronic Partner Platform)

A PDP is an e-invoicing service provider that is an official “partner” of the state. By becoming an official partner, the service provider guarantees certain tax and legal requirements in regard to the exchanged invoice information. The main job of the PDP is to report the exchanged invoice information to the PPF.

A PDP can exchange invoices in other formats – in addition to those of the PPF (CII/UBL/Factur-X) for connected B2B partners. A PDP can also have point-to-point connections to other PDPs.

OD – Opérateur de Dématérialisation (Electronic Operator)

An OD is a service provider which is not certified by the DGFID. They are able to exchange invoice information with the PPF – but only in the authorised formats CII, UBL and Factur-X.

The different options for exchanging B2B invoices in France

1) Both parties use the PPF directly or an OD

In this scenario either the supplier generates the invoice in their internal system and submits it to the PPF… or they use a service provider. In the latter case, the service provider performs the transformation of the invoice (from inhouse format to CII/UBL/Factur-X) and submits it for the supplier.

The buyer, meanwhile, can either fetch the invoice from the PPF or retrieve it via an OD (e.g. which converts to the inhouse format of the buyer). During the transition period the supplier may submit a PDF to the PPF.

The PPF also provides a web interface for entering data manually

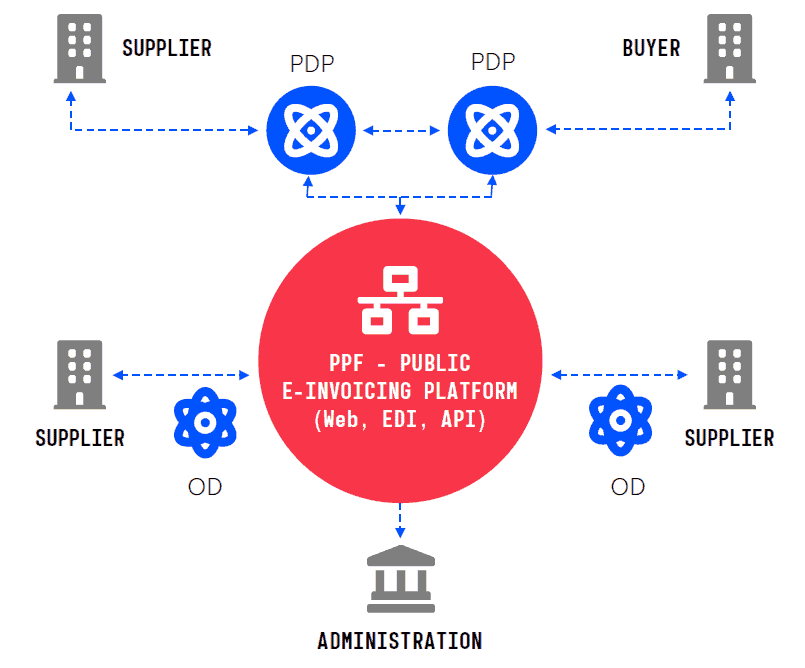

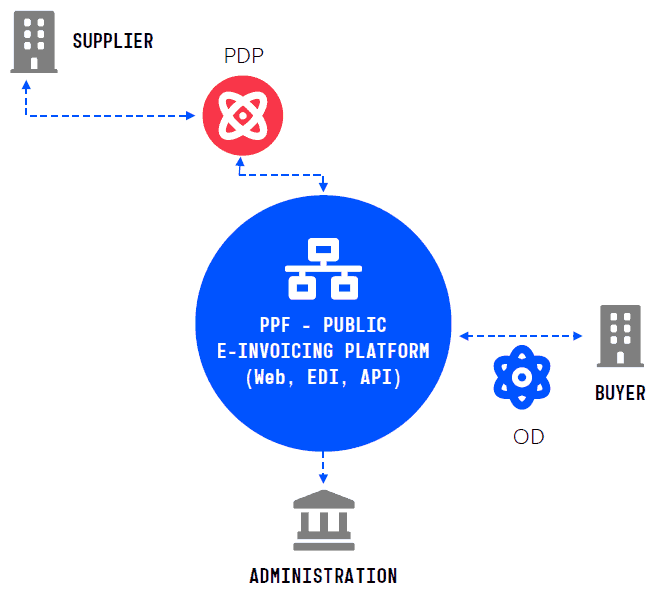

2) The supplier uses a PDP

In this scenario the supplier sends the invoice to their PDP. The PDP then translates the invoice to the target format of the PPF (CII/UBL/Factur-X).

On the buyer’s side, they retrieve the invoice from the PPF – either directly or via an OD.

No direct exchange of invoice data between buyer and supplier is possible, because only one uses a PDP.

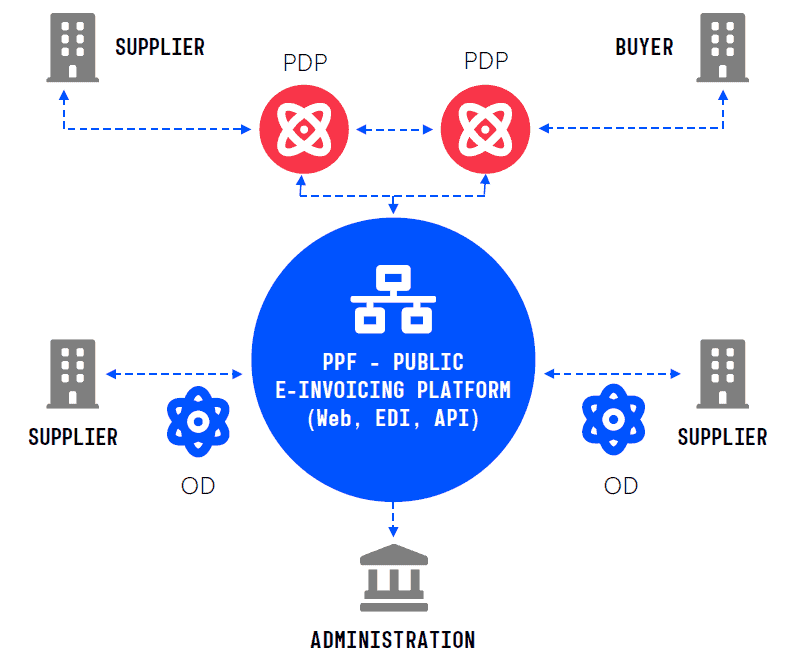

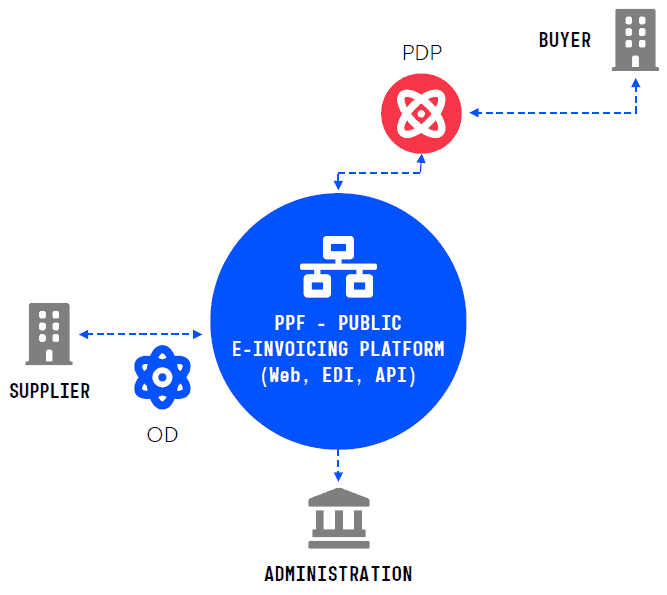

3) The buyer uses a PDP

In this scenario the supplier sends the invoice to the PPF – either directly or via their OD.

On the buyer’s side the PDP fetches the invoice data from the PPF and provides it in the desired format to the buyer (e.g. SAP IDoc). The buyer can then directly process the invoice information in their system.

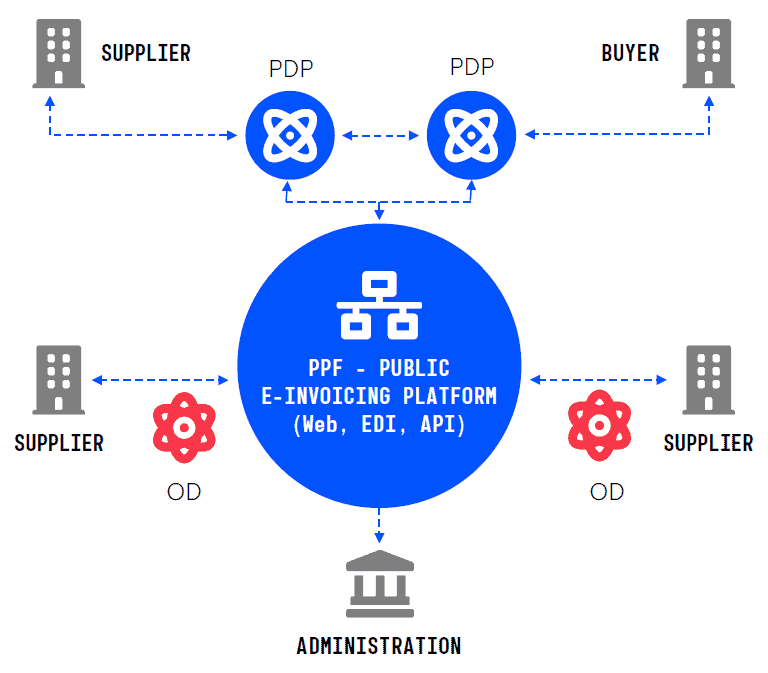

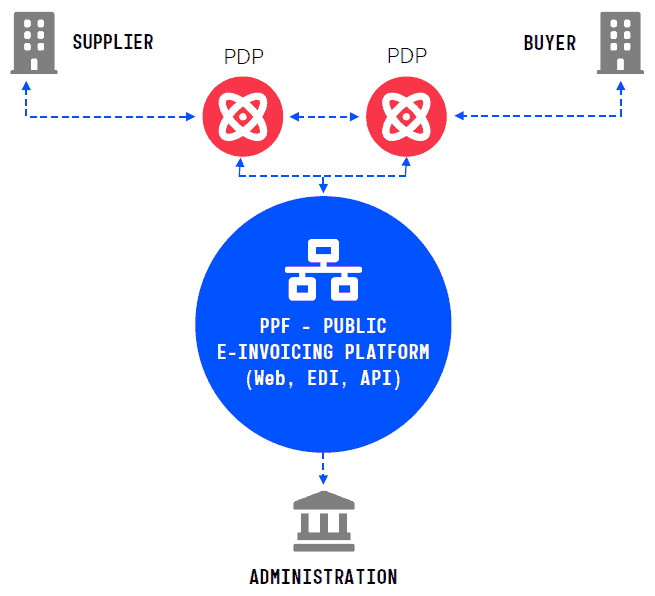

4) Both supplier and buyer use a PDP

In this scenario the supplier sends the invoice to their PDP, which translates the invoice to the format as agreed with the PDP of the buyer (e.g. EDIFACT). The supplier‘s PDP then sends the invoice to the buyer’s PDP. Concurrently, the supplier’s PDP translates the supplier’s invoice to one of the official formats of the PPF (CII/UBL/Factur-X) and sends it to the PPF.

On the other side, the buyer’s PDP receives the invoice for the buyer, translates it to the buyer’s desired import format and delivers it to their system.

5) One partner uses an OD connected to a PDP

In the case that one partner has a service provider, which is an OD, but is not connected to the PPF, the OD may use one of the existing PDP providers and send invoices via the PDP to the PPF. Thus existing OD setups may stay in place.

Cross-border invoices

All cross-border invoices – regardless of whether they are sent or received – must be reported to the PPF. A PDP can provide the necessary infrastructure to report the cross-border invoices to the PPF.

Processes and technical requirements

What formats are accepted?

The public invoicing portal in France complies with European standard EN 16931

Officially supported formats by the French public invoicing portal, the Portail Public de Facturation (PPF) are:

A) Pure XML

- Cross Industry Invoice (CII)

- Universal Business Language (UBL)

B) Hybrid format

Factur-X with the profiles…

- BASIC

- BASIC WL

- EN 16931

- EXTENDED

What data is required?

The table below lists data that will be required during the first phase (start-up phase) of the transition to mandatory e-invoicing, plus the data which will be required once the system is fully finalised.

Required information |

Start-up phase |

Final phase |

| Identity number specified in the first sub-paragraph of Article R 123-221 of the Commercial Code (SIREN) – taxable person | X | |

| Individual identification number provided for in Article 286 ter of the General Tax Code (intra-community VAT number)–taxableperson | X | |

| Individual identification number provided for in Article 286 ter of the General Tax Code (intra-community VAT number) – tax representative of the taxable person | X | |

| Country – taxable person | X | |

| Identity number specified in the first sub-paragraph of Article R 123-221 of the Commercial Code (SIREN) – customer | X | |

| Individual identification number provided for in Article 286 ter of the General Tax Code (intra-community VAT number) – customer | X | |

| Country – customer | X | |

| Category of the transaction: delivery of goods (LB) / supply of services (PS) / dual (LBPS) |

X | |

| Date of issue of the invoice | X | |

| Unique invoice number | X | |

| Corrected invoice number if a corrective invoice is issued | X | |

| Option to pay VAT on debits (the due date is not the date of receipt) | X | |

| Total excluding VAT broken down by tax rate | X | |

| Corresponding tax amount broken down by tax rate | X | |

| Applicable VAT rate (to be broken down if multiple) | X | |

| Total amount payable excluding VAT | X | |

| Tax amount payable | X | |

| In case of exemption, reference to the legal provision | X | |

| Invoice currency code/description | X | |

| “Self-billing” indication | X | |

| Reference to a special scheme referred to in Article 242 nonies A (15 and 16 of I) | X | |

| “Reverse charge” indication | X | |

| Date of delivery of the goods or completion of the service | X | |

| Date of advance payment if different from date of issue of the invoice | X | |

| Price reduction (price discounts, discounts, rebates) | X | |

| Precise description of the goods delivered or services rendered | X | |

| Quantity of goods delivered or services rendered | X | |

| Price excluding VAT for each item of goods delivered or services rendered | X | |

| Delivery/service address, if different from the customer address | X | |

| Date of issue of the corrected invoice in the case of correcting invoice | X | |

| Discount information | X | |

| Eco-contribution (Art. L.541-10 of the Environmental Code) | X |

What is still unclear?

In principle, all the important points have been clarified, as explained above. However, there are still several things to be clarified. For example, will there be a list of service providers? What technology will be used for the transfer? …and so on… Further consultations and workshops will take place in France before the final implementation of the new regulations – so be sure to check back soon.

Helpful links

L’Agence pour l’Informatique Financière de l’Etat (AIFE for short) has been set up as the authority with national responsibility for e-invoicing – here you will find useful information and all the links to the required platforms (although so far only in French).

The official regulation published on 15 September 2021 can be found on the French website “Légifrance” (you will need French language skills).

How do I stay technically compliant?

Since both French e-invoicing regulations and e-invoicing regulations elsewhere are constantly evolving, implementing a future-proof and flexible e-invoicing solution is wise.

To ensure technical compliance and to implement all the requirements and benefits of e-invoicing, companies can either implement and manage e-invoicing processes internally or outsource them to a specialised service provider such as ecosio.

However, implementing and managing e-invoicing processes internally usually requires a lot of effort and time from companies – not only does the technical expertise around e-billing and electronic data interchange (EDI) have to be available and up to date, the e-invoicing processes that are ultimately used also have to be constantly monitored and in the event of errors, they have to be reacted to quickly accordingly.

If a specialised service provider is used, ideally they can take care of all e-invoicing issues. In this way, companies relieve internal teams of all tasks related to e-invoicing, such as monitoring exchanged invoices or technical updates or changes in requirements, and offer proactive troubleshooting in case of incorrect invoicing – not only in France but also in many other countries where e-invoicing has been (or will be) introduced on a mandatory basis.

How ecosio can help

As a fully managed EDI service provider, ecosio makes e-invoicing effortless.

To find out more about our e-invoicing services, please visit our E-invoicing and Peppol solution page. Alternatively, if you have any questions why not contact us directly? We are always happy to provide assistance however we can and look forward to helping you implement a successful e-invoicing solution.