Using FatturaPA

Since March 2015 the Italian administration has accepted invoices in electronic format (FatturaPA) over the Sistema di Interscambio (SdI). Italy is thus following the European (and increasingly global) trend of e-invoicing for Business-to-Government (B2G). Certain countries, such as Denmark, have been enforcing e-invoicing for over a decade, whilst Latin and South America in particular are also ahead of the curve in this area.

Italy however decided to take it one step further and make e-invoicing mandatory for Business-to-Business (B2B). Since 1.1.2019, Italian regulations have required all invoices between businesses registered in Italy to be exchanged via Sistema di Interscambio. From 2022 this will extend to all cross-border invoicing too. This concerns all domestic companies in Italy who own a VAT-ID, as well as providers and suppliers who are registered in Italy. Therefore, any company from the UK, Germany, Switzerland, Austria, etc. who has branches in Italy must comply.

Distinction of the term

A lot of the terms around FatturaPA are not used in the right context or not interpreted in the correct way. This may be due to the fact that most documentation only exists in Italian.

We have listed the most important terms here for you…

FatturaPA

Abbreviation for Fatturazione Elettronica verso la Pubblica Amministrazione, or in English E-Invoicing for the Public Administration. This is the umbrella term that describes the technical and organisational steps taken in Italy around e-invoicing to the public administration. Those steps were extended to invoicing between all businesses in Italy from 1.1.2019. You will find more information on this topic on the official website.

InvoicePA

InvoicePA is the XML format that needs to be used for invoices exchanged within the FatturaPA system.

Sistema di Interscambio (SdI)

SdI refers to the central data hub that the invoice data needs to be transmitted to. Several channels are available for the delivery and extraction of the invoices, such as web interfaces or web services.

AgID – Agenzia per l’Italia digitale

AgID is a public facility that drives digitisation topics in Italy. It was created in 2012 under Monti’s government. It is relevant for FatturaPA, since all archiving solutions for e-invoicing need to certified by AgID.

Registration process for FatturaPA

In order to exchange invoices compliant to FatturaPA, you will need to undertake a few organisational and technical steps, as detailed below.

Instead of registering one’s company, an external service provider such as ecosio may be hired. The external service provider then submits and receives invoices on behalf of the company. Thereby, the difficult registration process may be skipped.

If a company wants to register itself with FatturaPA, this will need to be done by an employee of the Italian branch with signing authority. To register, the following access data can be used:

- Entratel

- Fisconline

- Carta Nazionale dei Servizi

You will need to discuss this with the contact at your Italian branch, as it is possible that one of the above listed option is already available and can be used for that purpose. Once you’ve registered, you need to define a technical contact to set up the connection. The norm is here to choose a technical contact from your EDI provider, so that he can take over the coordination from then on.

The next step is to register a technical communication channel. To do so, you will need the following information:

- Name of the company

- Italian Tax number

- PEC email address

- Website

- Name, email and phone number of the contact person in the company

Once the registration process is completed, technical details such as certificates and login details will be sent to the PEC email address entered during registration.

Sending the invoice data

Following are the channels allowing the exchange of e-invoice data to FatturaPA. We are differentiating between manual and automated processes.

Manual process:

A manual process indicates the need of human intervention, which makes it inadequate for high invoice volumes or a fully automated transmission. Both of the following channels are available for manual processes:

- Transmission via certified email (PEC)

- Input of the invoice data through a web form

Automated process

In this case the data transmission happens automatically, without human intervention. This allows for the data to be directly exported from your ERP system and sent to FatturaPA. Thus, this process is more suitable for high invoice volumes. These are the automated channels available:

- SDICoop Web Service

- SPCoop Web Service

- SDIFTP Service

ecosio uses SPCoop Web Service to support the transmission, thereby allowing a deep integration of the invoice exchange into the ERP system. Deep integration gives you the opportunity to transfer receipt and processing confirmation from the FatturaPA system into the ERP system.

Data integration from the ERP system

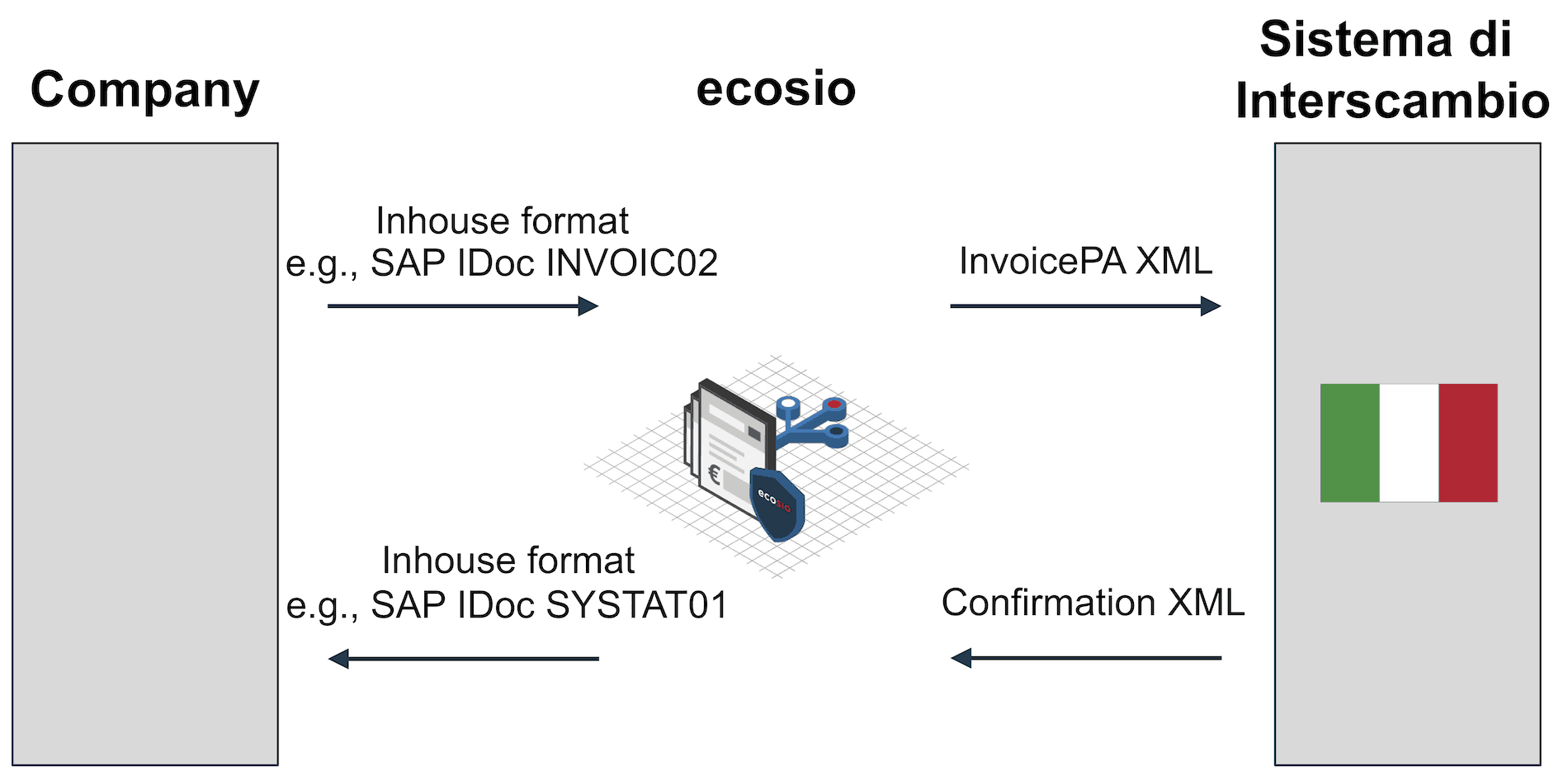

The below example illustrates the transfer of an invoice to FatturaPA using Web Service via ecosio.

Invoices are automatically created in the ERP system and sent to ecosio. This can be done with any communication protocol and the invoices can be in any ERP export format. However, all the conditions required by FatturaPA need to be fulfilled.

ecosio extracts the ERP export data, translates it to the InvoicePA format and transfers it using Web Service via SdI.

Transmission of Electronic Invoices using FatturaPA

Next, the SdI Web Service sends a receipt confirmation back, which will either be positive or negative. A negative confirmation is sent when, for example, the data in the invoice was incomplete or the wrong recipient ID was entered. If SdI sends a positive confirmation back, this means that the invoice was received correctly from a technical point of view. This doesn’t mean yet that the recipient accepted or processed it, as there is a second confirmation for this.

The SdI service forwards the invoice to its final recipient. As soon as the invoice has been received by the final recipient, a positive business acknowledgement is returned to the sender. If after 15 days the invoice has not been received by the recipient, the SdI service automatically sends an expiration note which will result in the invoice being voided.

ecosio can upon reception make both confirmations in an ERP import format available, allowing the reception and processing status to be integrated into the ERP system.

The suppliers can thus see in real time whether their invoice has been processed by the recipient or not.

Invoice format

The electronic invoice transfer format used by FatturaPA is the InvoicePA XML format. You can find the corresponding XML template under this link. Before sending the XML data, it needs to be secured with a digital signature. The below two signature formats are allowed:

- CAdES-BES (CMS Advanced Electronic Signature)

- XAdES-BES (XML Advanced Electronic Signature)

The digital signature will be added by ecosio on behalf of the customer before sending.

Data archiving

The Italian legislation foresees certain conditions with regard to the storage of invoices that were exchanged via SdI. To begin with, invoices need to be archived for at least 10 years. Then the archived invoices need to be secured with a qualified digital signature. Most importantly, whichever archiving solution you choose, it needs to be AgID certified, hence guaranteeing that the solution complies with the rules of the Italian authorities.

Questions?

Do you have any more questions about e-invoicing with FatturaPA? Please do contact us or use our chat – we’re more than happy to help!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.